Team:Calgary Entrepreneurial/Project/Finance

From 2013.igem.org

Rpgguardian (Talk | contribs) |

Rpgguardian (Talk | contribs) |

||

| Line 70: | Line 70: | ||

</html>[[File:Calgary2013 CashFlowWorksheet.png|700px|centre]]<html> | </html>[[File:Calgary2013 CashFlowWorksheet.png|700px|centre]]<html> | ||

| + | |||

| + | <p>Several assumptions for this analysis were made:</p> | ||

| + | <ul> | ||

| + | <li><p>This assumes we only capture the monitoring market that is established in the government regulation framework.</p></li> | ||

| + | <li><p>It takes 4 months to get paid out of large oil producer accounts, so assume that for September - December these sales will be represented in the next year.</p></li> | ||

| + | <li><p>No sales costs because we don't have people who would get commission</p></li> | ||

| + | <li><p>Shipping costs are billed to the customer</p></li> | ||

| + | <li>Shipping costs were determined based on US Postal Service rates for pallet shipments Internationally with DNDC destination and 5 cartons . Assumed that one shipment a month occurs at $150 per shipment.</p></li> | ||

| + | <li>Final Packaging Costs were estimated based on | ||

| + | Packaging per cartridge cost was estimated based on bacterial addition definition in manufacturing section of being an additional $1.10</p></li> | ||

<h2>Funding Our Venture</h2> | <h2>Funding Our Venture</h2> | ||

Revision as of 03:54, 28 October 2013

FREDsense's website works best with Javascript enabled, especially on mobile devices. Please enable Javascript for optimal viewing.

Finances

With our business plan in place, FREDsense Technologies needed a strategic method to obtain funding in the future. We assess from our market evaluation, the potential of annual revenue of over $2 million from our flagship product, with approximately a $1.6 million investment over a 3 year term to bring the technology to the Alberta market. We have developed a funding strategy to provide these needed funds in a realistic time frame, and a strategic framework to ensure our company is profitable in the shortest possible time frame.

Bringing It All Together - A Financial Summary of Our Business Plan

Market Evaluation

Our market evaluation has shown the potential for FREDsense Technologies to operate in the highly regulated field of oil and gas related water quality monitoring. We see an enormous potential impact our technology could play in this market. We have assessed that the general toxin sensing market represents a $50 million dollar opportunity. Our full assessment of the market is specific to Alberta’s oil and gas monitoring and does not cover the wide platform of testing that our technology can cover. These additional markets include waste water monitoring, non-regulatory testing for private companies and agricultural monitoring streams, all of which are potential market opportunities for our diverse platform technology.

Cost To Develop Our Product

From our manufacturing analysis which was done in collaboration with provincial government programs, we were able to determine the potential cost of developing our prototype into an actual product. From this analysis we have been able to predict that our prototype development will take approximately 1 year at a cost of ~$250,000. A single cartridge for the detection of toxins in a water sample could cost approximately $4.10 and the detector could cost approximately $251.00. The sales price of our cartridges and detector systems were set at $150 and $2,500 respectively to be competitive and more cost effective than other products presently used in this market. Being almost 20x and 10x below our sale price respectively, these numbers appear reasonable to obtain profitability and were used in determining our profitability in the market (see below).

Company Profitability In Our Market

By 2015, there will be well over 500 sampling sites mandated to be monitored for their water quality in the province of Alberta. Each one of these monitoring sites are required to take a variable number of samples at different locations around the sites as well as a variable number of periods throughout the year. By estimating the potential number of sites that could use our technology, our group estimates that the total market potential of our general toxin sensor is $8.75 Million annually. If our technology could displace 30% of this market, their is the potential of producing a $2.6 Million annual revenue for our general toxin sensor alone.

Financial Barriers To Market

Numerous hurdles exist in being able to bring this technology to market, the largest of which being the necessary regulatory assessment hurdles needed to for our technology to be used as a standard (a single EPA application could cost as much as $350,000 posing a critical issue in developing our company). In addition, marketing will be a critical aspect to ensure that the market adopts our technology. Government endorsement, and industry backing from end-users will aid in this development. A summary of the findings of major barriers to entry into the market is below:

- Technology Development (Biological, Engineering, Hardware, Software)

- Prototype Development - Bench Scale and Up-Scale

- Regulatory Approval (EPA, Health Canada, Environment Canada, etc.)

- Marketing

- IP Protection

- Team Selection, Attracting and Retaining Talent

Overhead and Expenses

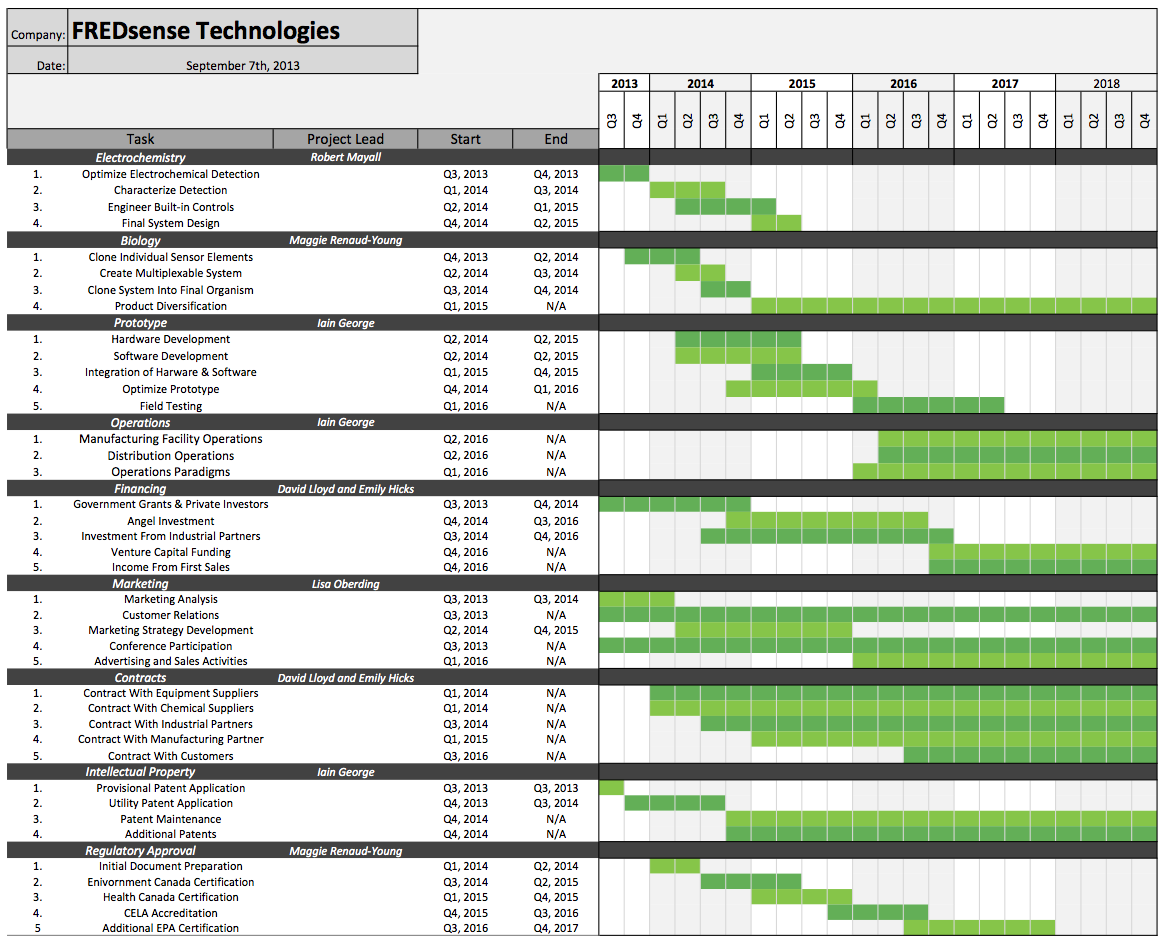

Below is a breakdown of the expected expenses of the business for the years of 2014-2016, dictating the amount of capital that will be required in order to achieve our goals. This was also inspired by our milestones timeline whereby we expect to have a product ready for the market by 2016.

This makes several assumptions listed below:

Salaries were determined based upon the need of attracting new talent to our business, as described in the operations section of the business plan.

Equipment funds assume government grants will reduce the overall cost of the equipment components.

Prototyping fees have been assessed to be a total of $200,000-$250,000 with an approximate development round of 4 months per prototype assessment with 5 rounds of prototyping required to finalize the product. This will occur from the later part of 2014 onwards to the beginning of 2016.

While prototyping is occurring in 2015-2016 so will field-testing, on commercially available samples.

As our technology is developing, new intellectual property will be generated, and this is reflected in our profitability analysis in the legal section.

-

The budget places emphasis on numerous components of the company's development, namely those listed above the detailed expenses list. The budget requires that we raise significant capital funding for our business, requiring $2 million to bring our product to market by the year 2013. The budget reflects a number of assumptions. These include being able to supply ourselves with numerous laboratory equipment through government granting programs and university technology transfer programs available in Alberta. This also assumes that for up-scale of our prototype towards commercialization, we have the ability to partner with a manufacturing group to supply the equipment required to produce our product. Additionally, the expenses of becoming certified through numerous government programs may be variable depending on the particular legislation. Therefore we plan to tackle Environment/Health Canada certification prior to more expensive certification programs such as those offered by the Environment Protection Agency in the United States.

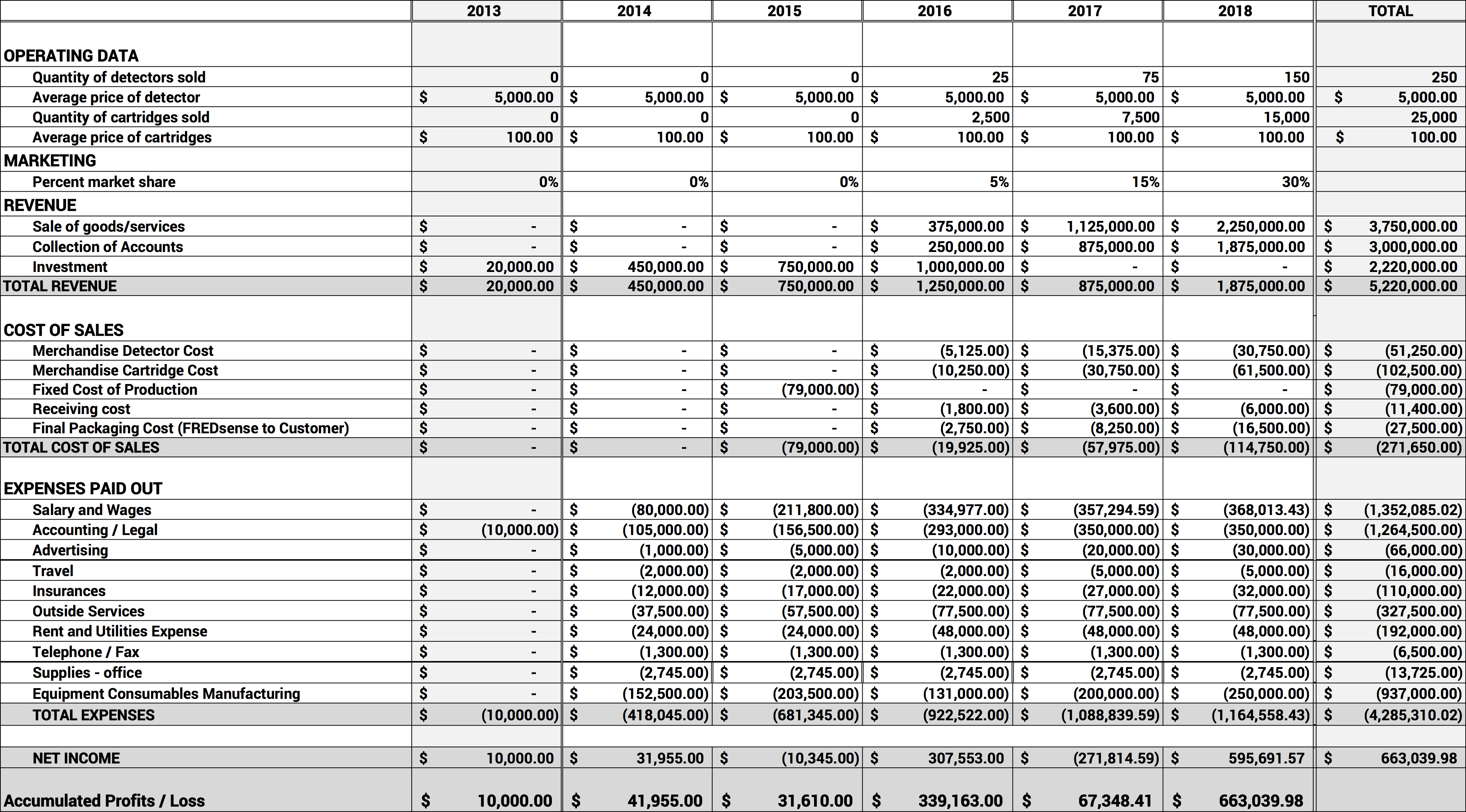

Estimating Company Profitability

With this financial assessment and our annual predicted revenue from the product once it has reached the market, it will take approximately 1.5 years to recoup the cost of investment prior to the company becoming profitable. Beyond this timeline, our group aims to establish international connections in other areas of the world where this technology would be useful.

Several assumptions for this analysis were made:

This assumes we only capture the monitoring market that is established in the government regulation framework.

It takes 4 months to get paid out of large oil producer accounts, so assume that for September - December these sales will be represented in the next year.

No sales costs because we don't have people who would get commission

Shipping costs are billed to the customer

- Shipping costs were determined based on US Postal Service rates for pallet shipments Internationally with DNDC destination and 5 cartons . Assumed that one shipment a month occurs at $150 per shipment.

- Final Packaging Costs were estimated based on Packaging per cartridge cost was estimated based on bacterial addition definition in manufacturing section of being an additional $1.10

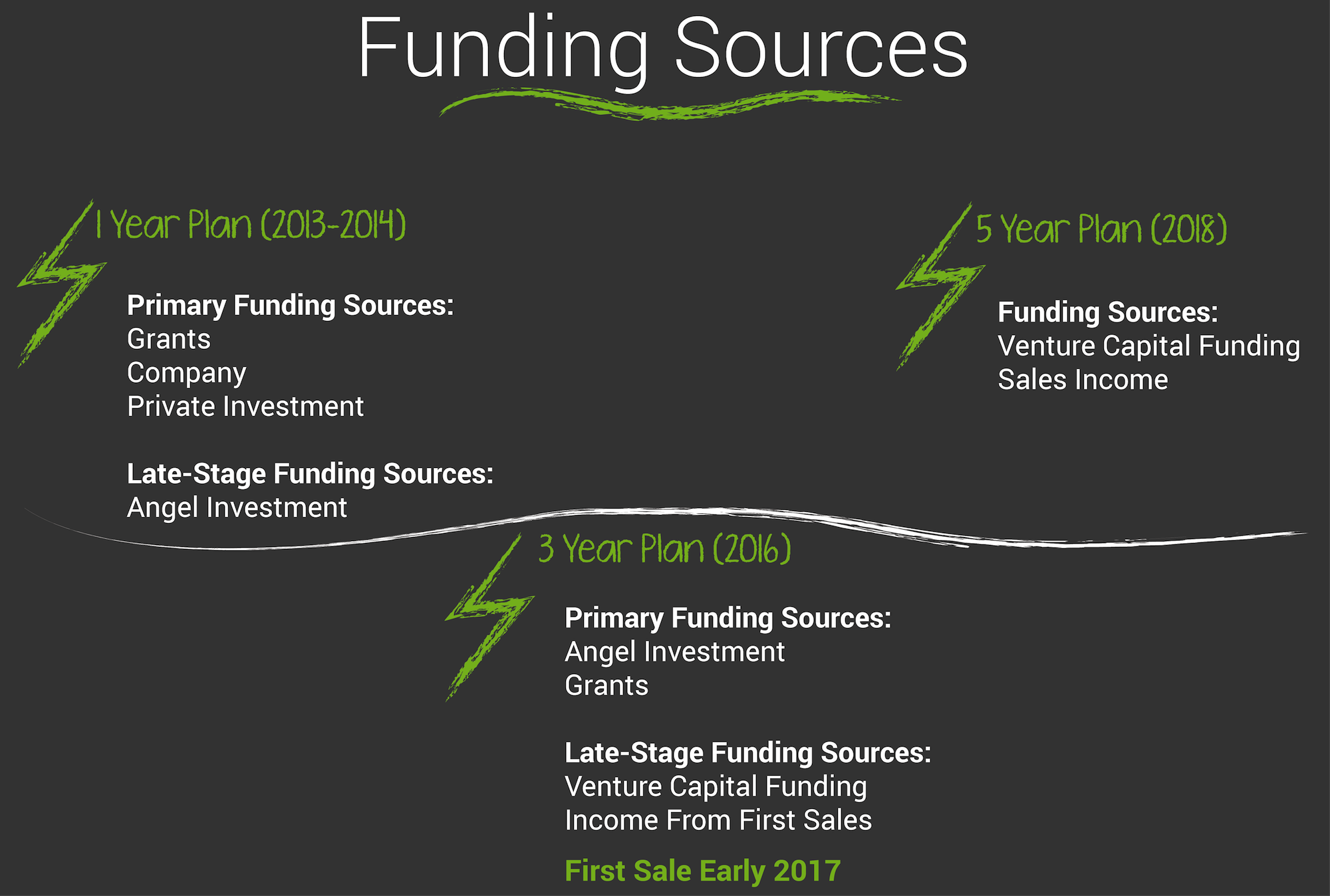

Funding Our Venture

In order to gain the funds required, a financial commitment is required. To achieve this we have demonstrated a need for multiple rounds of funding from government granting programs, industry collaboration and partnerships, angels, and venture capitalists.

At our present stage, we plan to facilitate the need for our approximately $350,000 start-up costs through government granting programs, personal funding, and industry collaboration. Our team aims to use numerous provincial and federal opportunities to subside salaries, reagent and equipment costs, as well as the legal and administrative concerns.

In the subsequent years we plan on strategically targeting angel investment as a method to ensure our technologies development. Manufacturing opportunities will allow for decreased cost of prototyping development and producing our product.

After release of our product into the market in 2016, we aim to seek venture capital funding to take our company to the next level, expanding into new domestic and international markets across the world.

"

"