Team:Calgary Entrepreneurial/Project/Risk

From 2013.igem.org

FREDsense's website works best with Javascript enabled, especially on mobile devices. Please enable Javascript for optimal viewing.

Risk Analysis

Risk is an extremely important factor of any venture. The key to mitigating risk is to first understand possible risks before they happen, and develop a comprehensive plan to deal with them. Analyzing key strengths, weaknesses, opportunities and threats, a SWOT analysis, can also help in determining where issues may arise.

Understanding our Risks

As with any start-up venture, there are a wide variety of risks that we could encounter. The key to managing these risks is to understand the possibility of them occurring and plan carefully as to how we would mitigate each risk should it arise. There are many different types of risks that we could face including legal, financial, technological & operational, market, people and systemic risks.

Legal Risks

For FREDsense Technologies, we foresee that our key risks will be in the legal category, surrounding the regulatory landscape. As our product is designed to meet a growing market need in Alberta surrounding monitoring in the oil sands industry, successful penetration of our market will involve gaining the necessary safety and technology approval for use in mandated monitoring. This poses a significant risk; if we are unable to obtain this regulatory approval, we will need to identify an alternative route to market or potentially encounter difficulties in industry adoption of our technology. Possible reasons for an inability to obtain this approval could be due to lack of capital to do so, time pressures, or technical details of our technology that cannot be modified to meet requirements for both. In order to mitigate this risk, we have developed two strategies:

Should the accreditation process take longer than expected, we will utilize our other marketing strategy which involves targeting individual companies and environmental groups for monitoring outside of government-mandated regulation. Although this may present a smaller market opportunity, this would allow us to generate some initial revenue while we navigate the accreditation process.

If the process proves to be overly time- or resource-dependent, we may decide to completely change our target market. We have developed our product to make use of a versatile detector platform. This not only facilitates development of additional cartridge systems for targeting additional compounds of interest, but will let us easily move into other markets. As such, should we encounter significant difficulties in meeting regulatory standards in the oil and gas sector, we may find that minor changes to our engineered strains will allow us to focus in on additional, less-regulated markets. An example of this is in the waste water management industry.

Outside of the regulatory domain, other legal risks could involve the potential for lawsuits filed against us should our product cause harm. Strategies to mitigate these risks will involve obtaining proper insurance (i.e. business liability and product liability insurance). In addition, should our product not work as expected, we plan to offer a full refund to customers. As adoption by key players in the industry seems to influence large-scale adoption in the oil and gas sector, this would be necessary in order to maintain our image and bolster our sales among potential customers

Market Risks

As with any early venture, market risks are always important to consider. Particularly as our product will have a significant time to market with first sales projected for late 2016, changes to market demand could impact the success of our company significantly. In order to mitigate this serious risks, we have employed several strategies. We have developed a partnership with a large prospective customer, HydroQual Laboratories. Through sustaining detailed discussions and eventual testing of our prototypes with them, we are helping to ensure that our design continues to meet industry needs. In addition, as mentioned above, we may also make use of our versatile platform sensing system to move into other, more stable markets such as industrial food processing.

An additional possible risk is that our product does make use of a genetically modified organism. Although we have taken every step possible to ensure that our final product will be safe to use and will not pose any environmental concerns, there is always the possibility that a negative public perception of genetically modified organisms will result in lower adoption of our technology. As such, we have begun to explore additional designs for our product that would make use of an in-vitro system, allowing us to remove the bacterial component of our final product all together.

Technological and Operational Risks

Another very serious category of risks for FREDsense technologies is technological risks. Although alternative target markets could be entered should unforeseen regulatory or market hurdles be encountered, serious shortcomings in the technology could pose significant risk to the company’s viability. There are key research and development milestones, as described previously, that need to be completed in order to reach a prototype stage. Should some of these key steps prove difficult or unfeasible, we will need to re-evaluate our technology. In order to mitigate this risk, we have developed a comprehensive technological implementation plan that focuses on completing high-risk activities first. This will enable us to make any major changes in the design of our product early on, allowing us to avoid significant increases in time and costs which would occur if changes were made later on. In addition, we are exploring alternative methods of designing our sensor should one of these challenges prove to be insurmountable. As well, it is important to consider changes in the cost of the components of the technology. We have designed our cartridge system to be as economically viable as possible as discussed in the operations section. Should the cost of any one component drastically increase however, we may need to re-design our system. This would likely involve changing electroactive substrates in order to reduce cost. Although this would slightly increase the time needed for research and development, if it would enable us to meet our financial goals, it may be necessary.

Financial Risks

As a technology-based company, financial hurdles are likely to be significant for us, particularly for early research and development activities as well as for production. As such, there is always risk that we will not be able to secure the required funding for each stage. In order to mitigate these risks, we have developed a comprehensive budget for the next three years and a cash flow analysis for the next 5 years. This budget will be updated as cost projections change and will allow us to carefully plan our spending. In addition, should we find ourselves in a position where we require extra finances that we cannot acquire, we will suspend all research and development activities not focused on reaching the market for our first generation product.

People Risks

Risks in terms of key personnel in our company have been outlined and contingency plans developed. These can be found on our management page.

Systemic Risks

Finally, systemic risks are an important category to consider. In terms of FREDsense Technologies, this could involve drastic changes to government-mandated regulation in the oil and gas sector. As our market opportunity is largely due to significant changes that affect regulated monitoring in Alberta, this could drastically affect the usefulness and viability of our products. Although this is extremely unlikely, as trends seem to suggest that regulation will increase in the industry, it is still important to consider. In the event that this occurred, we would shift our focus to target other more stable markets. Again, as much of the research and development activities of FREDsense focus on developing our versatile detector platform, transitioning into another market using this would not represent a serious setback in terms of timelines.

Risk Factor Analysis

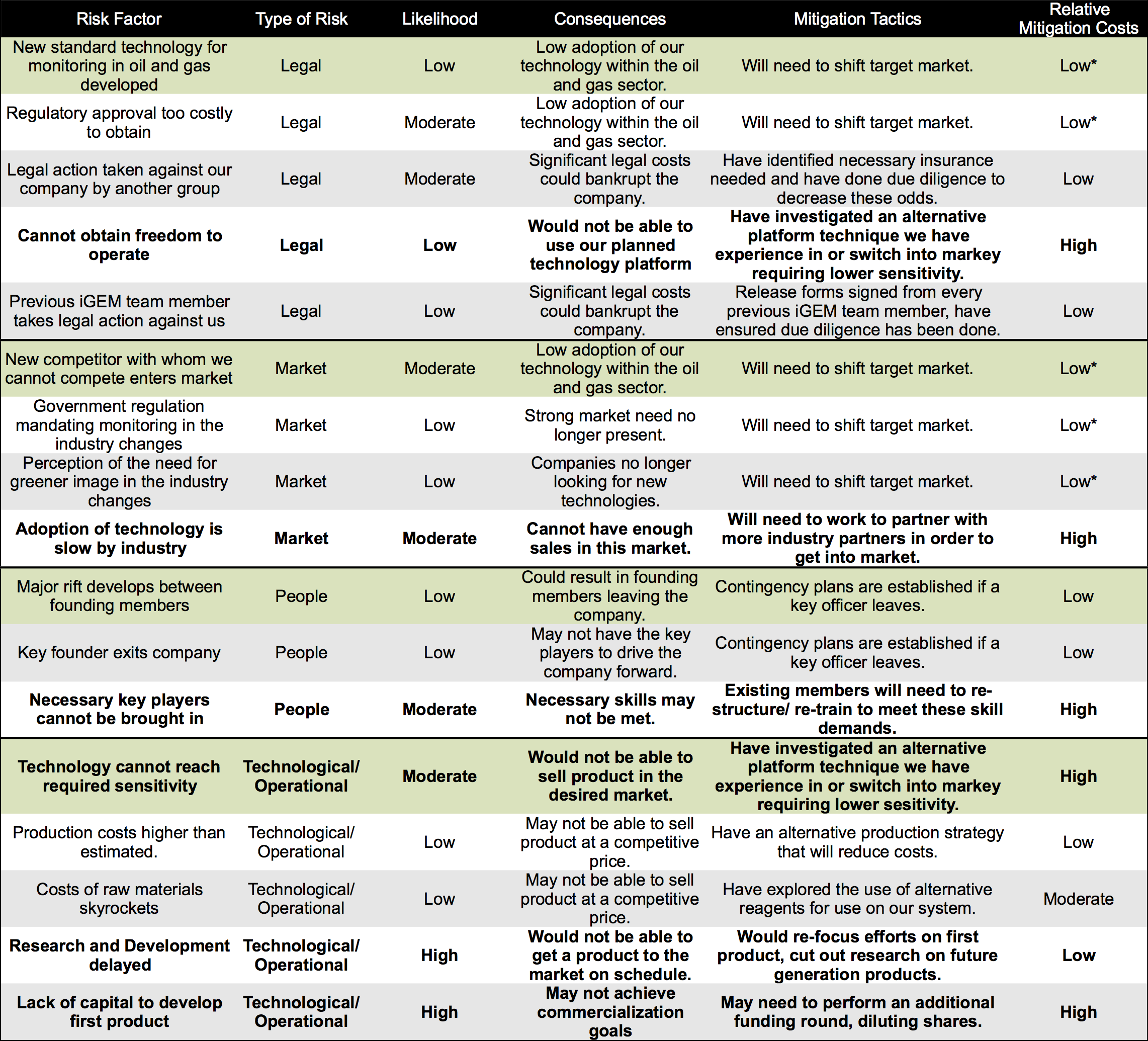

In order to start designing a comprehensive strategy to minimize our potential risks, we have done a risk factor analysis. We have identified some of the key risks that our start-up could face as well as the type of risk and likelihood of occurring for each. We then came up with possible mitigation strategies and their relative cost. Although this likely does not cover all of the possible risks that we could face, starting our risk assessment early will hopefully help us avoid making critical mistakes.

* Relative costs variable due to new market. Markets requiring high sensitivity of analysis or specific regulatory challenges could invoke significantly high costs both in terms of financing and time. Versatility of platform would allow for relatively easy transition, thus we have made an assumption of low cost.

SWOT Analysis

In order to better understand our position in relation to risk, we performed a SWOT analysis. Here we identified four key areas: our strengths, weaknesses, opportunities and threats as shown below.

Key Strengths and Weaknesses

Several key advantages can be seen in our SWOT analysis. These include the versatility of our technology platform and the significant advantages our products can offer over existing technologies. These strengths are things we need to maintain, build and leverage. Through development of our first generation product, we will be optimizing our platform in order to facilitate the development of next generation products.

Despite our strengths, we also need to be wary of our venture's weaknesses. These include the primarily technology-focused background of our key members and the high costs that we will incur in bringing our first product to market. These weaknesses are things we need to remedy and constantly assess for risk. In terms of our overly technical backgrounds, we have brought on a dedicated advisory board in order to bridge some of the gaps in our knowledge and experience. In addition, in our management section, we have made a plan to bring in key players at critical times in the first years of operations in order to better fill some of the most important gaps. This is also reflected in our budget. In terms of our high requirement for finances, we have developed cost-effective options for producing our first product and have plans to cut costs should we need to, such as suspending future research and development activities.

Key Opportunities and Threats

Several key opportunities can also be seen in our SWOT analysis. These include the significant market opportunity we see in Alberta with the increased monitoring that has been mandated by the Alberta government, as well as the ability of our product to enter additional markets down the road. Opportunities are things that we need to prioritize or optimize. Based on the clear market opportunity, we are focusing our efforts on making this our first target market. As we develop our first generation product however, we will be optimizing our detector device for easy transitioning into a second market.

Finally, we need to consider threats, which are perhaps the most important component of this. For us, threats include the potential for a significant time for market for our first product and the potential for a competitor to enter the market. If we could not compete with this competitor, this could pose significant difficult for us in achieving our target market potential. As we are aiming to develop a lower-cost alternative to existing technologies already in the market, there is also the possibility that potential competitors would try to litigate us as they see us as serious competition. As an early-stage venture, this could pose serious risk to us. Threats need to be countered as they have the potential to critically disrupt our business. To this end, we have several strategies in place. If competitors offering significant advantages over us were to enter the market, we could again consider switching into an alternative target market. In terms of a possible litigation against us, we are actively ensuring that we protect ourselves legally and perform our due diligence. Finally, although our time to market for our first product is significant, by optimizing the design of our detector device and moving into research and development for future generation products while we bring our first product to market, we will ensure that subsequent products will have a much quicker development time. This is also helped by the fact that our manufacturing and distribution processes will be identical for second and third generation products, allowing us again to save time and money. This means that although we will incur significant costs during the development of our first generation product, we will hopefully be able to quickly recoup those once our products begin to hit the market in rapid succession.

"

"