Team:Calgary Entrepreneurial/Project/Finance

From 2013.igem.org

Rpgguardian (Talk | contribs) m |

|||

| (49 intermediate revisions not shown) | |||

| Line 1: | Line 1: | ||

| - | {{Team:Calgary_Entrepreneurial/ | + | {{Team:Calgary_Entrepreneurial/ProjectPage |

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

|ABSTRACT= | |ABSTRACT= | ||

<html> | <html> | ||

<h1>Finances</h1> | <h1>Finances</h1> | ||

| - | <p> | + | <p>With our business plan in place, FREDsense Technologies needed a strategic method to obtain funding in the future. We assess from our market evaluation, the potential of annual revenue of over $2 million from our flagship product, with approximately a $2 million investment over a 3 year term to bring the technology to the Alberta market. We have developed a funding strategy to provide these needed funds in a realistic time frame,<a name="eval"></a> and a strategic framework to ensure our company is profitable in the shortest possible time frame.</p> |

| + | </html> | ||

| + | |||

| + | |CHALK= | ||

| + | <html> | ||

| + | <img class="chalk" src="https://static.igem.org/mediawiki/2013/2/26/2013CalgaryE_chalk_business_plan.png"></img> | ||

</html> | </html> | ||

| Line 24: | Line 15: | ||

<html> | <html> | ||

| - | <h1> | + | <h1>Market Evaluation</h1> |

| + | <p>Our market evaluation has shown the potential for FREDsense Technologies to operate in the highly regulated field of oil and gas related water quality monitoring. We see an enormous potential impact our technology could play in this market. We have assessed that the general toxin sensing market represents a <b>$50 million dollar</b> opportunity. Our full assessment of the market is specific to Alberta’s oil and gas monitoring and does not cover the wide platform of testing that our technology can cover. These additional markets include waste water monitoring, non-regulatory testing for private companies and agricultural monitoring streams, all of which are potential market opportunities for our diverse platform technology.</p> | ||

| - | < | + | <p>By 2015, there will be well over <b>500 sampling sites</b> mandated to be monitored for their water quality in the province of Alberta. Each one of these monitoring sites are required to take a variable number of samples at different locations around the sites as well as a variable number of periods throughout the year. By estimating the potential number of sites that could use our technology, our group estimates that the total market potential<a name="dev"></a> of our general toxin sensor is <b>$7.5 Million annually</b>. If our technology could displace 30% of this market, their is the potential of producing a <b>$2.25 Million annual revenue</b> for our general toxin sensor alone.</p> |

| - | < | + | |

| - | < | + | <h1>Cost To Develop Our Product</h1> |

| - | <p>From our manufacturing analysis which was done in collaboration with | + | <p>From our manufacturing analysis which was done in collaboration with provincial government programs, we were able to determine the potential cost of developing our prototype into an actual product. From this analysis we have been able to predict that our prototype development will take approximately 1 year at a cost of <b>~$250,000</b>. A single cartridge for the detection of toxins in a water sample could cost approximately <b>$4.10</b> and the detector could cost approximately <b>$251.00</b>. The sales price of our cartridges and detector systems were set at $100 and $5,000 respectively to be competitive and more cost effective than<a name="bar"></a> other products presently used in this market. Being almost 20x below our sale price, these numbers appear reasonable to obtain profitability and were used in determining our profitability in the market (see below). </p> |

| - | < | + | <h1>Financial Barriers To Market</h1> |

| - | <p> | + | <p>Numerous hurdles exist in being able to bring this technology to market, the largest of which being the necessary regulatory assessment hurdles needed to for our technology to be used as a standard (a single EPA application could cost as much as $350,000 posing a critical issue in developing our company). In addition, marketing will be a critical aspect to ensure that the market adopts our technology. Government endorsement, and industry backing from end-users will aid in this development. A summary of the findings of major barriers to entry into the market is below: |

| - | < | + | <ul> |

| - | < | + | <li>Technology Development (Biological, Engineering, Hardware, Software)</li> |

| + | <li>Prototype Development - Bench Scale and Up-Scale</li> | ||

| + | <li>Regulatory Approval (EPA, Health Canada, Environment Canada, etc.)</li><a name="over"></a> | ||

| + | <li>Marketing</li> | ||

| + | <li>IP Protection</li> | ||

| + | <li>Team Selection, Attracting and Retaining Talent</li> | ||

| + | </ul> | ||

| - | + | <h1>Overhead and Expenses</h1> | |

| - | < | + | |

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

<p>Below is a breakdown of the expected expenses of the business for the years of 2014-2016, dictating the amount of capital that will be required in order to achieve our goals. This was also inspired by our milestones timeline whereby we expect to have a product ready for the market by 2016.</p> | <p>Below is a breakdown of the expected expenses of the business for the years of 2014-2016, dictating the amount of capital that will be required in order to achieve our goals. This was also inspired by our milestones timeline whereby we expect to have a product ready for the market by 2016.</p> | ||

| - | </html>[[File:Calgary2013 DetailedExpenseBudget.png|800px|centre]]<html> | + | </html>[[File:Calgary2013 DetailedExpenseBudget.png|700px|centre]]<html> |

| + | |||

| + | <p>This makes several assumptions listed below:</p> | ||

| + | <ul> | ||

| + | <li><p>Salaries were determined based upon the need of attracting new talent to our business, as described in the operations section of the business plan. Additionally, we accounted for inflation throughout the years.</p></li> | ||

| + | <li><p>Equipment funds assume government grants will reduce the overall cost of the equipment components. 2014 electrochemical equipment expenses are higher than other years as they account for the purchase of a potentiostat. Subsequent years account for maintenance. Additionally, molecular biology equipment assumes lab support through government programs therefore requiring minimal input for large equipment. Engineering equipment will be minimal as it only reflects research and development for small scale prototypes.</p></li> | ||

| + | <li><p>Prototyping fees have been assessed to be a total of $200,000-$250,000 with an approximate development round of 4 months per prototype assessment with 5 rounds of prototyping required to finalize the product. This will occur from the later part of 2014 onwards to the beginning of 2016. </p></li> | ||

| + | <li><p>Consumables were based on averages collected during the 2012 iGEM season, examining the cost of technology development.</p></li> | ||

| + | <li><p>While prototyping is occurring in 2015-2016 so will field-testing, on commercially available samples. Prototype equipment costs were based upon commercially available quotes for lyophilization systems. We plan to be a small scale system in 2015 and a full production sized system in 2016. This is similar for our bioreactor systems. Prototyping costs were made based upon our manufacturing calculations.</p></li> | ||

| + | <li><p>Consultation fees were determined based upon the assumption that a consultation with industry will cost from $100-$125 per hour with an average number of hours of 100 per year. These would be with end-users and outsourcing particular skillsets we require.</p></li> | ||

| + | <li><p>Market evaluation was determined based upon government grant programs for market assessments. In 2015-2016 market evaluations will be more limited to potential new markets and ventures for our current and next generation products.</p></li> | ||

| + | <li><p>Field testing will require access to other analytical devices and third party services to compare our technology platform to other standard methods. This can be incredibly costly, a single GC/MS sample and other systems can cost between $150-$250 per sample. We assumed four different detection methods at 50 independent samples at a cost of $150 per submission which will continue to grow in 2016 to a large number of samples.</p></li> | ||

| + | <li><p>As our technology is developing, new intellectual property will be generated, and this is reflected in our profitability analysis in the legal section.</p></li> | ||

| + | <li><p>Costs for patenting were based upon a rough estimate of $10,000 per provisional patent and $50,000-$70,000 per utility filing. This assumes that our first provisional will be filed in 2014, and two patents will be issued by 2016. Miscellaneous legal fees would include the drafting of all documents relating to customer agreements, non-disclosure agreements, sales agreements, etc. These will begin to increase as our first product hits the market. Cost were based on hourly rates of $250-$500.</p></li> | ||

| + | <li><p>Regulatory approval costs will include, in 2015, approximately $21,500 for Environment Technology Verification (ETV) approval and an additional $10,000 dollars for necessary toxicity and growth assays as required for general safety verification by CEPA. In 2016, this will increase to $43,000, accounting for new approvals for subsequent technology and an additional $50,000 to begin USA Environmental Protection Agency assessment.</p></li> | ||

| + | <li><p>Travel costs will occur between labs, as we will have research and development activities occurring in both Calgary and Edmonton.</p></li> | ||

| + | <li><p> Travel for promotional related events will be highest in the early phases as we try to network and seek advice from potential customers.</p></li> | ||

| + | <li><p>Telephone and fax services are based on current prices in Calgary. These will commence in 2014 when we begin to rent office space.</p></li> | ||

| + | <li><p> Insurance increases annually as the business grows and sales commence. Key insurance for our venture will be business liability insurance as well as product liability insurance.</p></li> | ||

| + | </ul> | ||

| + | |||

| + | <p> The budget places emphasis on numerous components of the company's development, namely those listed above the detailed expenses list. The budget requires that we raise significant capital funding for our business, requiring <b>$2 million</b> to bring our product to market by the year 2016. The budget reflects a number of assumptions. These include being able to supply ourselves with numerous laboratory equipment through government granting programs and university technology transfer programs available in Alberta. This also assumes that for up-scale of our prototype towards commercialization, we have the ability to partner with a manufacturing group to supply the equipment required to produce our product. Additionally, the expenses of becoming certified through numerous government programs may be variable depending<a name="prof"></a> on the particular legislation. Therefore we plan to tackle Environment/Health Canada certification prior to more expensive certification programs such as those offered by the Environment Protection Agency in the United States.</p> | ||

| + | |||

| + | <h1>Estimating Company Profitability</h1> | ||

| + | |||

| + | <p>With this financial assessment and our annual predicted revenue from the product once it has reached the market, it will take approximately <b>2 years to recoup the cost of investment and break-even</b> prior to the company becoming profitable. Beyond this timeline, our group aims to establish international connections in other areas of the world where this technology would be useful.</p> | ||

| + | |||

| + | </html>[[File:Calgary2013 CashFlowWorksheet.png|800px|centre]]<html> | ||

| + | |||

| + | <p>Several assumptions for this analysis were made:</p> | ||

| + | <ul> | ||

| + | <li><p>This assumes we only capture the monitoring market that is established in the government regulation framework.</p></li> | ||

| + | <li><p>No sales costs because we don't have people who would get commission.</p></li> | ||

| + | <li><p>Shipping costs are billed to the customer.</p></li> | ||

| + | <li><p>Shipping costs were determined based on US Postal Service rates for pallet shipments Internationally with DNDC destination and five cartons. Assumed that one shipment a month occurs at $150 per shipment.</p></li></a> | ||

| + | <li><p>Final Packaging Costs were estimated based on packaging per cartridge cost was estimated based on bacterial addition definition in manufacturing section of being an additional $1.10</p></li> | ||

| + | <li><p>In 2013, the majority of expenses will be legal fees, in terms of patent application fees,incorporation fees and the drafting of legal documents, such as release forms and non-disclosure agreements.</p></li> | ||

| + | <li><p>In 2014, legal fees increase significantly due to regulatory costs and increasing consultation with legal experts./p></li> | ||

| + | <li><p>Travel costs are minimal, however will increase in 2017 for promotional related events. These will increase as sales increase in order to visit potential customers.</p></li> | ||

| + | </ul> | ||

| + | |||

| + | <h2>Company Evaluation</h2> | ||

| + | |||

| + | <p>In order to estimate our potential company evaluation today and in the future, we have performed a Asset Valuation for our company. These were based on the following criteria:</p> | ||

| + | <ul> | ||

| + | <li><p><b>Team Evaluation</b> - Based on the technical abilities our team has acquired we valued these skills as a valuation towards the company. As we continue to attract talent this is assessed.</p></li> | ||

| + | <li><p><b>Sweat Equity</b> - As many of our team members will be unable to be reimbursed for their time in the company we have made an evaluation for this contribution. This was based on the commitment level that the team member is making and their role overall in the progress of the company.</p></li> | ||

| + | <li><p><b>Patents</b> - Patents provide a clear advantage to the company. We have assessed a value of a provisional patent to be $50,000 towards the company's value and a full utility patent at a $1,000,000 contribution to the valuation. We plan to have a series of patents to protect our technology by 2018.</p></li> | ||

| + | <li><p><b>Manufacturing</b> - Establishing appropriate manufacturing contacts, facilities, prototyping development, and distribution are critical in the success of the company. These were taken into consideration in this analysis.</li> | ||

| + | <li><p><b>Customers and Sales</b> - Both having a customer base (market segment control) and sales to these customers were taken into consideration based on the number of customers and the size of the contracts that we would hold with these members based on previous evaluations made in our financial reporting</p></li> | ||

| + | <li><p><b>Investment</b> - Finally, contribution through investments or loans are considered to count towards the value of the company. This was determined by estimated contributions from 2014-2016.</p></li> | ||

| + | </ul> | ||

| + | |||

| + | <p>See the figure below for a summary of our evaluation:</p> | ||

| + | |||

| + | </html>[[File:Calgary2013 CompanyEvaluationGraph.png|600px|centre]]<html> | ||

| + | |||

| + | <a name="funds" style="display: block; position: relative; top: -4em;"></a> | ||

| + | <h1>Funding Our Venture</h1> | ||

| + | |||

| + | |||

| + | </html>[[File:Calgary2013 FundingSourcesTimeline.png|700px|centre]]<html> | ||

| + | |||

| + | |||

| + | <p>In order to gain the funds required, a financial commitment is required. To achieve this we have demonstrated a need for multiple rounds of funding from government granting programs, industry collaboration and partnerships, angels, and venture capitalists.</p> | ||

| + | |||

| + | <p>At our present stage, we plan to facilitate the need for our approximately $450,000 start-up costs through government granting programs, personal funding, and industry collaboration. Our team aims to use numerous provincial and federal opportunities to subside salaries, reagent and equipment costs, as well as the legal and administrative concerns.</p> | ||

| + | |||

| + | <p>In the subsequent years we plan on strategically targeting angel investment as a method to ensure our technologies development. Manufacturing opportunities will allow for decreased cost of prototyping development and producing our product.</p> | ||

| - | + | <p>After release of our product into the market in 2016, we aim to seek venture capital funding to take our company to the next level, expanding into new domestic and international markets across the world.</p> | |

| - | < | + | |

| - | < | + | |

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

| - | + | ||

</html> | </html> | ||

}} | }} | ||

Latest revision as of 03:46, 29 October 2013

FREDsense's website works best with Javascript enabled, especially on mobile devices. Please enable Javascript for optimal viewing.

Finances

With our business plan in place, FREDsense Technologies needed a strategic method to obtain funding in the future. We assess from our market evaluation, the potential of annual revenue of over $2 million from our flagship product, with approximately a $2 million investment over a 3 year term to bring the technology to the Alberta market. We have developed a funding strategy to provide these needed funds in a realistic time frame, and a strategic framework to ensure our company is profitable in the shortest possible time frame.

Market Evaluation

Our market evaluation has shown the potential for FREDsense Technologies to operate in the highly regulated field of oil and gas related water quality monitoring. We see an enormous potential impact our technology could play in this market. We have assessed that the general toxin sensing market represents a $50 million dollar opportunity. Our full assessment of the market is specific to Alberta’s oil and gas monitoring and does not cover the wide platform of testing that our technology can cover. These additional markets include waste water monitoring, non-regulatory testing for private companies and agricultural monitoring streams, all of which are potential market opportunities for our diverse platform technology.

By 2015, there will be well over 500 sampling sites mandated to be monitored for their water quality in the province of Alberta. Each one of these monitoring sites are required to take a variable number of samples at different locations around the sites as well as a variable number of periods throughout the year. By estimating the potential number of sites that could use our technology, our group estimates that the total market potential of our general toxin sensor is $7.5 Million annually. If our technology could displace 30% of this market, their is the potential of producing a $2.25 Million annual revenue for our general toxin sensor alone.

Cost To Develop Our Product

From our manufacturing analysis which was done in collaboration with provincial government programs, we were able to determine the potential cost of developing our prototype into an actual product. From this analysis we have been able to predict that our prototype development will take approximately 1 year at a cost of ~$250,000. A single cartridge for the detection of toxins in a water sample could cost approximately $4.10 and the detector could cost approximately $251.00. The sales price of our cartridges and detector systems were set at $100 and $5,000 respectively to be competitive and more cost effective than other products presently used in this market. Being almost 20x below our sale price, these numbers appear reasonable to obtain profitability and were used in determining our profitability in the market (see below).

Financial Barriers To Market

Numerous hurdles exist in being able to bring this technology to market, the largest of which being the necessary regulatory assessment hurdles needed to for our technology to be used as a standard (a single EPA application could cost as much as $350,000 posing a critical issue in developing our company). In addition, marketing will be a critical aspect to ensure that the market adopts our technology. Government endorsement, and industry backing from end-users will aid in this development. A summary of the findings of major barriers to entry into the market is below:

- Technology Development (Biological, Engineering, Hardware, Software)

- Prototype Development - Bench Scale and Up-Scale

- Regulatory Approval (EPA, Health Canada, Environment Canada, etc.)

- Marketing

- IP Protection

- Team Selection, Attracting and Retaining Talent

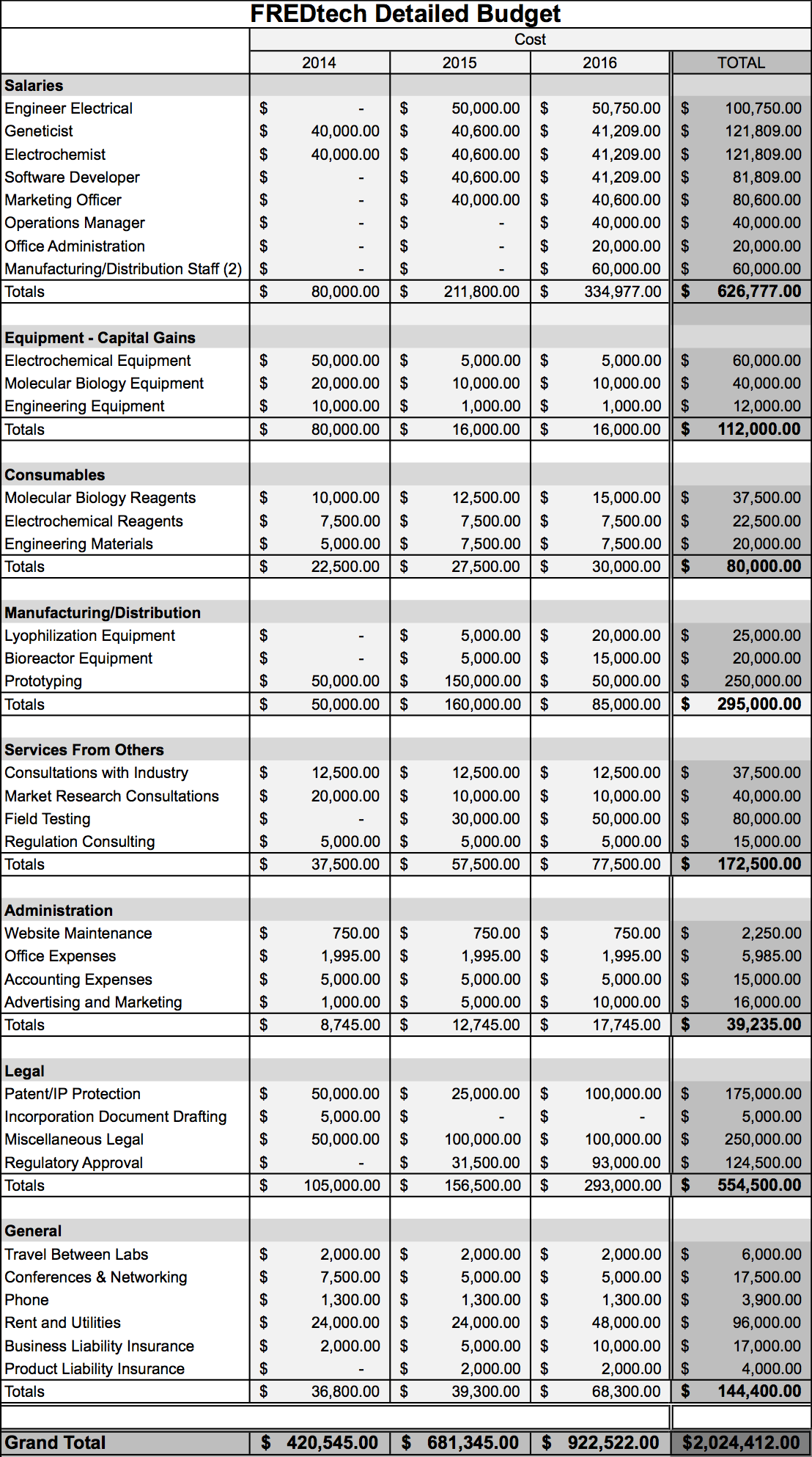

Overhead and Expenses

Below is a breakdown of the expected expenses of the business for the years of 2014-2016, dictating the amount of capital that will be required in order to achieve our goals. This was also inspired by our milestones timeline whereby we expect to have a product ready for the market by 2016.

This makes several assumptions listed below:

Salaries were determined based upon the need of attracting new talent to our business, as described in the operations section of the business plan. Additionally, we accounted for inflation throughout the years.

Equipment funds assume government grants will reduce the overall cost of the equipment components. 2014 electrochemical equipment expenses are higher than other years as they account for the purchase of a potentiostat. Subsequent years account for maintenance. Additionally, molecular biology equipment assumes lab support through government programs therefore requiring minimal input for large equipment. Engineering equipment will be minimal as it only reflects research and development for small scale prototypes.

Prototyping fees have been assessed to be a total of $200,000-$250,000 with an approximate development round of 4 months per prototype assessment with 5 rounds of prototyping required to finalize the product. This will occur from the later part of 2014 onwards to the beginning of 2016.

Consumables were based on averages collected during the 2012 iGEM season, examining the cost of technology development.

While prototyping is occurring in 2015-2016 so will field-testing, on commercially available samples. Prototype equipment costs were based upon commercially available quotes for lyophilization systems. We plan to be a small scale system in 2015 and a full production sized system in 2016. This is similar for our bioreactor systems. Prototyping costs were made based upon our manufacturing calculations.

Consultation fees were determined based upon the assumption that a consultation with industry will cost from $100-$125 per hour with an average number of hours of 100 per year. These would be with end-users and outsourcing particular skillsets we require.

Market evaluation was determined based upon government grant programs for market assessments. In 2015-2016 market evaluations will be more limited to potential new markets and ventures for our current and next generation products.

Field testing will require access to other analytical devices and third party services to compare our technology platform to other standard methods. This can be incredibly costly, a single GC/MS sample and other systems can cost between $150-$250 per sample. We assumed four different detection methods at 50 independent samples at a cost of $150 per submission which will continue to grow in 2016 to a large number of samples.

As our technology is developing, new intellectual property will be generated, and this is reflected in our profitability analysis in the legal section.

Costs for patenting were based upon a rough estimate of $10,000 per provisional patent and $50,000-$70,000 per utility filing. This assumes that our first provisional will be filed in 2014, and two patents will be issued by 2016. Miscellaneous legal fees would include the drafting of all documents relating to customer agreements, non-disclosure agreements, sales agreements, etc. These will begin to increase as our first product hits the market. Cost were based on hourly rates of $250-$500.

Regulatory approval costs will include, in 2015, approximately $21,500 for Environment Technology Verification (ETV) approval and an additional $10,000 dollars for necessary toxicity and growth assays as required for general safety verification by CEPA. In 2016, this will increase to $43,000, accounting for new approvals for subsequent technology and an additional $50,000 to begin USA Environmental Protection Agency assessment.

Travel costs will occur between labs, as we will have research and development activities occurring in both Calgary and Edmonton.

Travel for promotional related events will be highest in the early phases as we try to network and seek advice from potential customers.

Telephone and fax services are based on current prices in Calgary. These will commence in 2014 when we begin to rent office space.

Insurance increases annually as the business grows and sales commence. Key insurance for our venture will be business liability insurance as well as product liability insurance.

The budget places emphasis on numerous components of the company's development, namely those listed above the detailed expenses list. The budget requires that we raise significant capital funding for our business, requiring $2 million to bring our product to market by the year 2016. The budget reflects a number of assumptions. These include being able to supply ourselves with numerous laboratory equipment through government granting programs and university technology transfer programs available in Alberta. This also assumes that for up-scale of our prototype towards commercialization, we have the ability to partner with a manufacturing group to supply the equipment required to produce our product. Additionally, the expenses of becoming certified through numerous government programs may be variable depending on the particular legislation. Therefore we plan to tackle Environment/Health Canada certification prior to more expensive certification programs such as those offered by the Environment Protection Agency in the United States.

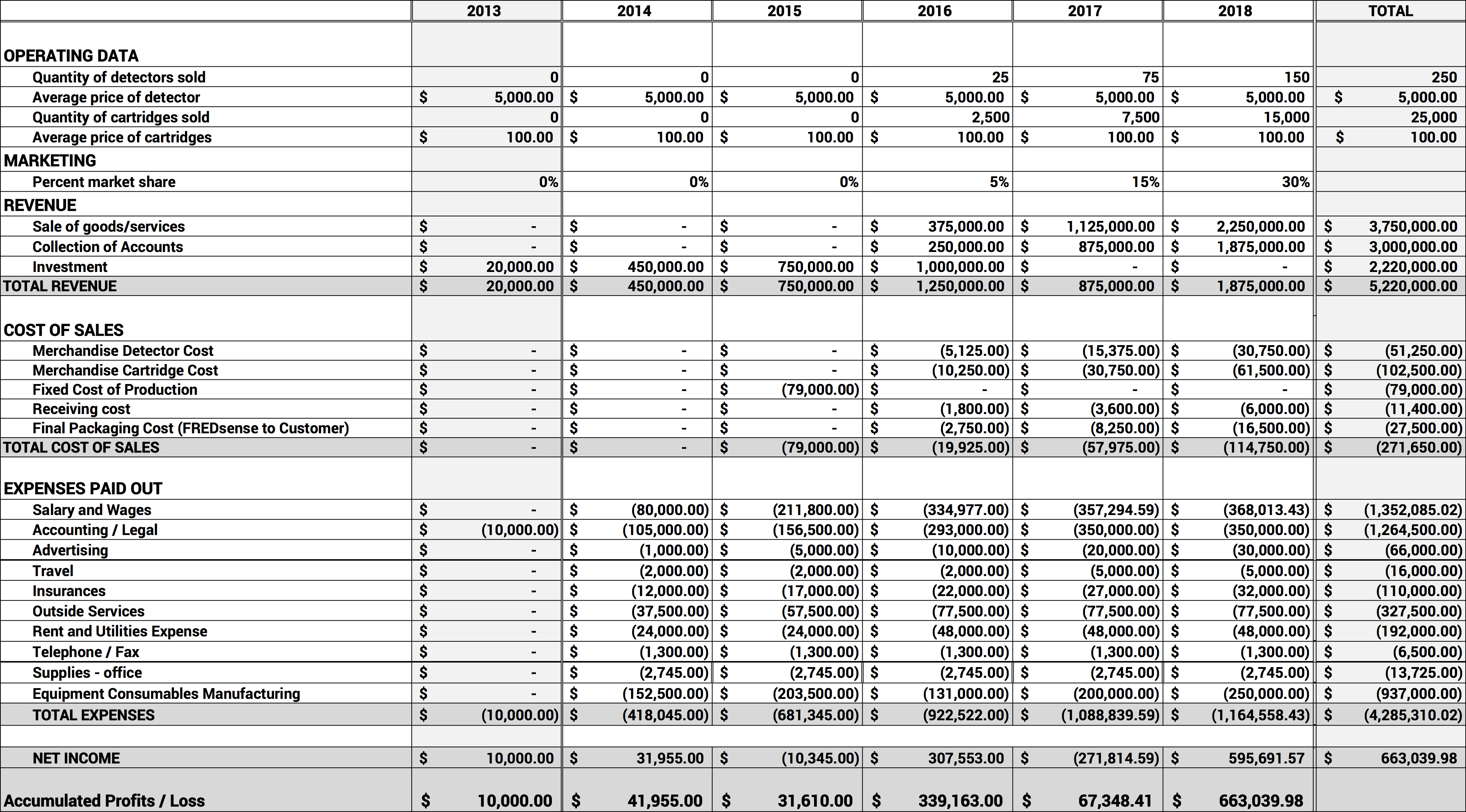

Estimating Company Profitability

With this financial assessment and our annual predicted revenue from the product once it has reached the market, it will take approximately 2 years to recoup the cost of investment and break-even prior to the company becoming profitable. Beyond this timeline, our group aims to establish international connections in other areas of the world where this technology would be useful.

Several assumptions for this analysis were made:

This assumes we only capture the monitoring market that is established in the government regulation framework.

No sales costs because we don't have people who would get commission.

Shipping costs are billed to the customer.

Shipping costs were determined based on US Postal Service rates for pallet shipments Internationally with DNDC destination and five cartons. Assumed that one shipment a month occurs at $150 per shipment.

Final Packaging Costs were estimated based on packaging per cartridge cost was estimated based on bacterial addition definition in manufacturing section of being an additional $1.10

In 2013, the majority of expenses will be legal fees, in terms of patent application fees,incorporation fees and the drafting of legal documents, such as release forms and non-disclosure agreements.

In 2014, legal fees increase significantly due to regulatory costs and increasing consultation with legal experts./p>

Travel costs are minimal, however will increase in 2017 for promotional related events. These will increase as sales increase in order to visit potential customers.

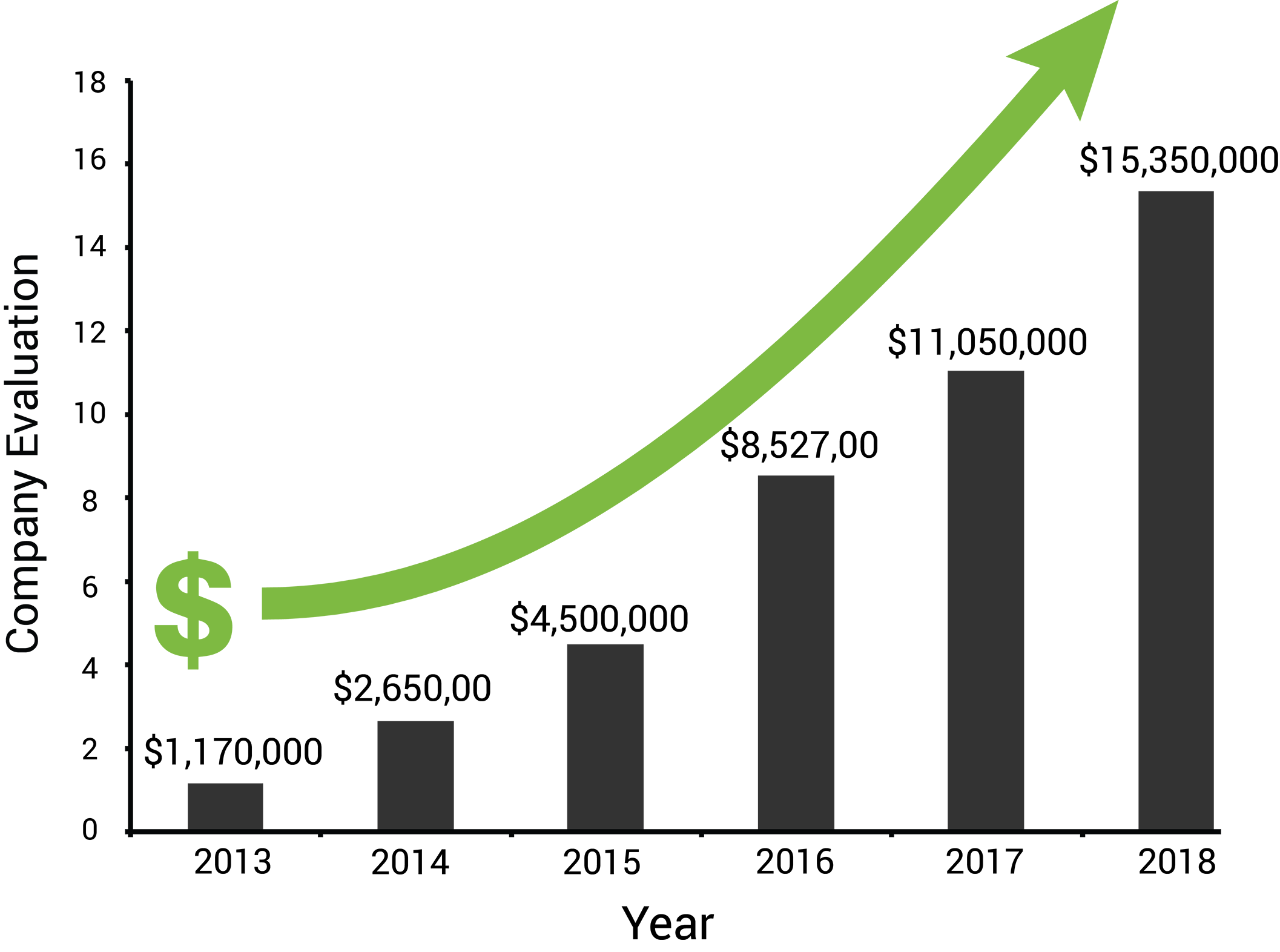

Company Evaluation

In order to estimate our potential company evaluation today and in the future, we have performed a Asset Valuation for our company. These were based on the following criteria:

Team Evaluation - Based on the technical abilities our team has acquired we valued these skills as a valuation towards the company. As we continue to attract talent this is assessed.

Sweat Equity - As many of our team members will be unable to be reimbursed for their time in the company we have made an evaluation for this contribution. This was based on the commitment level that the team member is making and their role overall in the progress of the company.

Patents - Patents provide a clear advantage to the company. We have assessed a value of a provisional patent to be $50,000 towards the company's value and a full utility patent at a $1,000,000 contribution to the valuation. We plan to have a series of patents to protect our technology by 2018.

Manufacturing - Establishing appropriate manufacturing contacts, facilities, prototyping development, and distribution are critical in the success of the company. These were taken into consideration in this analysis.

Customers and Sales - Both having a customer base (market segment control) and sales to these customers were taken into consideration based on the number of customers and the size of the contracts that we would hold with these members based on previous evaluations made in our financial reporting

Investment - Finally, contribution through investments or loans are considered to count towards the value of the company. This was determined by estimated contributions from 2014-2016.

See the figure below for a summary of our evaluation:

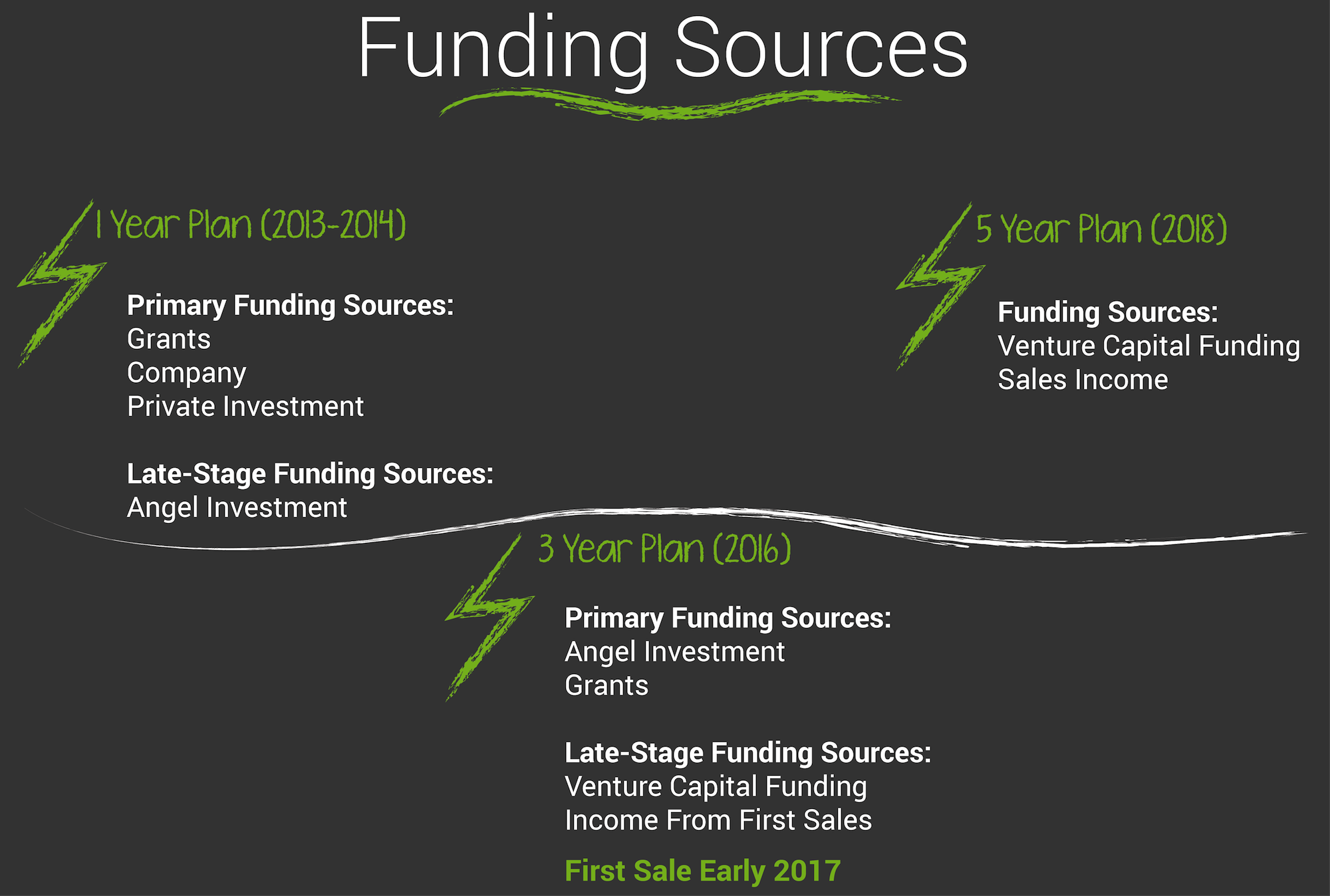

Funding Our Venture

In order to gain the funds required, a financial commitment is required. To achieve this we have demonstrated a need for multiple rounds of funding from government granting programs, industry collaboration and partnerships, angels, and venture capitalists.

At our present stage, we plan to facilitate the need for our approximately $450,000 start-up costs through government granting programs, personal funding, and industry collaboration. Our team aims to use numerous provincial and federal opportunities to subside salaries, reagent and equipment costs, as well as the legal and administrative concerns.

In the subsequent years we plan on strategically targeting angel investment as a method to ensure our technologies development. Manufacturing opportunities will allow for decreased cost of prototyping development and producing our product.

After release of our product into the market in 2016, we aim to seek venture capital funding to take our company to the next level, expanding into new domestic and international markets across the world.

"

"