Team:Calgary Entrepreneurial/Project/Market/

From 2013.igem.org

Rpgguardian (Talk | contribs) |

|||

| Line 31: | Line 31: | ||

<h2>Industry Description and Outlook</h2> | <h2>Industry Description and Outlook</h2> | ||

| - | <p>The oil and gas market is vast; today's operations in the Alberta Oil Sands produce 1.5 million barrels per day, which is expected to double by 2020. In North America, this market’s growth and increased oil production volumes has led to large increases in the amount of contaminated water that is stored by these operations. </p> | + | <p>The oil and gas market is vast; today's operations in the Alberta Oil Sands produce 1.5 million barrels per day, which is expected to double by 2020. In North America, this market’s growth and increased oil production volumes has led to large increases in the amount of contaminated water that is produced and stored by these operations. |

| + | During the oil sands extraction processes, water is often used to separate out the oil from the sand. During this process, the water becomes contaminated with fine silts alongside many highly toxic chemicals, making it unsafe to return to the environment. The potential toxicity from oil sands processed water (OSPW) has led to Alberta’s zero discharge policy. All oil sands tailings water must be stored in a contained environment (known as a tailings pond) where the fine silts are settled out so the water can be reused in oil sands processing streams. In the longer term, the water is stored with the goal of eventually remediating the toxins so that the site can be reclaimed.</p> | ||

| - | <p> | + | <p>Today, 200 million litres of contaminated tailings water is produced every day. These tailings ponds of contaminated water cover over 176 km<sup>2</sup>, an area 50% larger than the City of Vancouver. They are expected to reach 250 km<sup>2</sup> by 2020. Holding 840 million m3 of water as of today, this will expand their volume to 1.2 billion m<sup>3</sup> of water (<i>Comprehensive Guide to the Alberta Oil Sands - May 2011</i>). Every effort is made to reuse the water in the processing cycle, however it contains highly corrosive contaminants (naphthenic acids for example) that result from the extraction process and can cause corrosion damage to equipment that can lead to expensive repairs and costly shutdowns. In addition, these tailing ponds have been found to seep into the surrounding environment, releasing toxins into nearby rivers which harm wildlife and contaminate ecologically sensitive areas.</p> |

| - | <p> | + | <p>Stemming from concerns for environmental contamination, monitoring of wastewater and the surrounding environment is mandated by the government. Through the Joint Canada-Alberta Implementation Plan released in 2011, the number of ground & surface water quality and soil testing sites along rivers & ecologically sensitive areas is set to double by 2015, with more remote testing sites to be introduced. In this plan, costs for sampling are shared unequally between government and industry players. </p> |

| - | <p> | + | <p>Large oil companies generally hire environmental monitoring and consulting companies in order to do this testing. These groups either collect and test samples themselves or have samples from many waste streams shipped to a central facility for testing. These companies are actively searching for better technologies to rapidly detect toxic compounds in process water alongside existing soil, surface water, and groundwater testing. With more remote testing sites being introduced, they also require more portable technologies and are poised to be one of the largest customer bases for our technology. The environmental sensing and monitoring market is growing substantially. In the United States, it is expected to reach $15.3 billion by 2016. Environmental consulting in the United States made $1.2 billion in profit in 2012, and is expected to grow with a compound annual growth rate of 8.7% until 2018. About 40% of this industry is focused on water and soil quality management. Globally, the water and wastewater monitoring market as of 2012 was valued at 8 billion dollars.</p> |

| - | <p> | + | <p>In addition to the increased amount of legislation around environmental monitoring, many companies are moving towards adopting a greener image, and with it, more environmentally sound policies and management practices. Alongside a need for continuous monitoring, there is a demand for technology to pulse-spot test tailing ponds alongside sites with increased ecological significance with both regular testing as well as increased frequency tests during a water quality detection event.</p> |

| - | <p> | + | <p>As a portable, fast, on-site, and easy to use toxin detector, our technology could be used to meet the need in the market for a fast, pulse-spot testing system. With this technology, results could be obtained with shorter wait-times, on-site so that sample composition changes are minimized, and could be integrated into data management processes already used in industry. This would make our system ideal for environmental sampling in many remote locations, as well as for the analysis of water composition to detect corrosive compounds that could damage oil processing equipment when reusing process water.</p> |

| - | <p>Beyond environmental monitoring sites, contaminated water can cause significant issues when recycled back into oil sands processing systems. Oil companies are a robust second customer base, as we could provide fast on-site monitoring for compounds that could corrode and impair machinery. | + | <p>Beyond environmental monitoring sites, contaminated water can cause significant issues when recycled back into oil sands processing systems. Oil companies are a robust second customer base, as we could provide fast on-site monitoring for compounds that could corrode and impair machinery. Our system would act as a simple tool that could spot test monitor a given water channel providing valuable simple readout to the operator. This would add a valuable new monitoring system for oil sands plant operators to measure compounds which would potentially lead to a corrosion problem which were previously unable to be monitored on-site.</p> |

<h2>Target Markets </h2> | <h2>Target Markets </h2> | ||

| + | |||

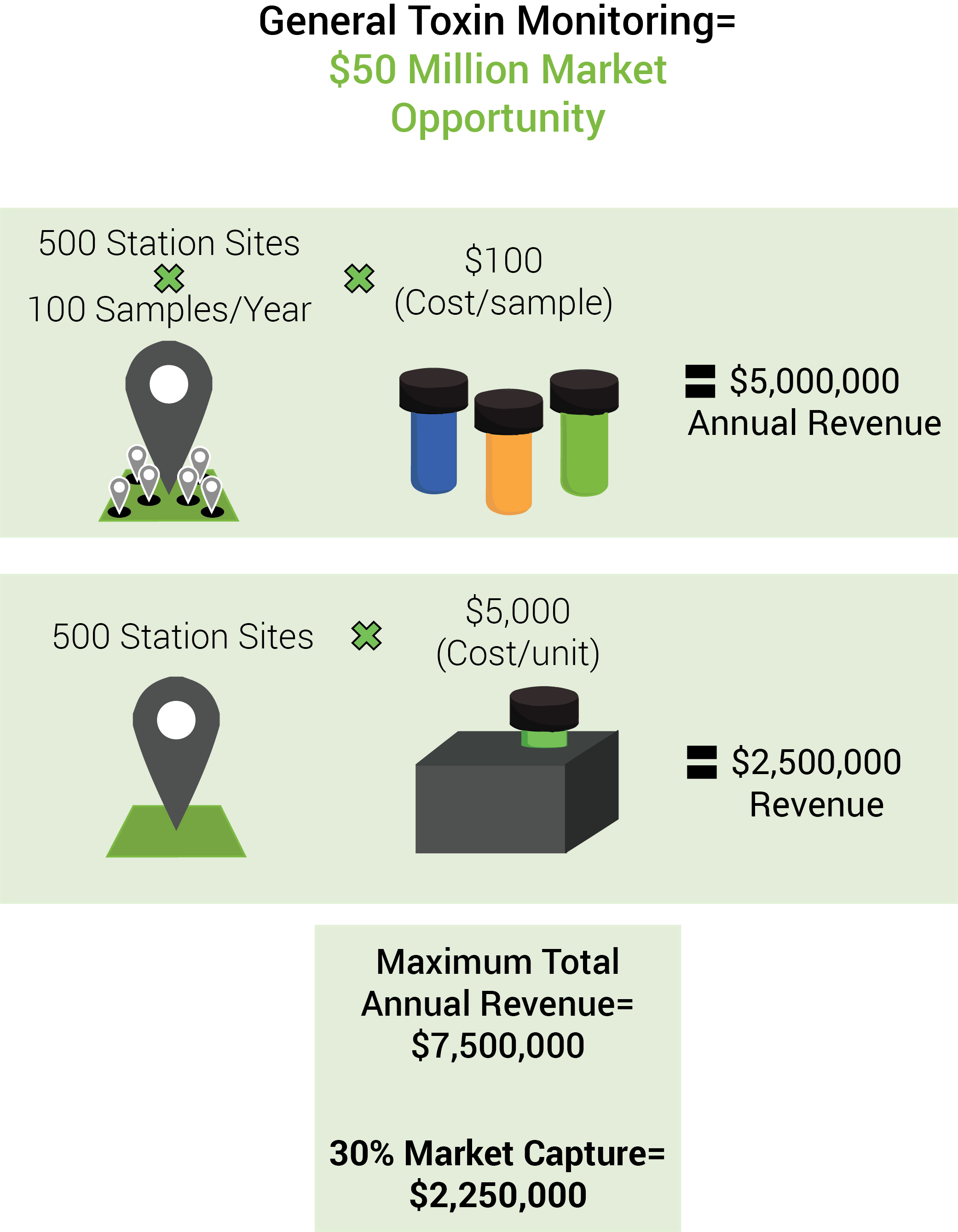

| + | <p>Our primary target market is water quality monitoring related to the oil and gas industry. This market segment is dominated by government environmental regulation. As such, it will be critical to align with government mandated requirements for monitoring technology as we will discuss in more detail. This regulation has led to a significant market opportunity due to large increases in the already numerous number of government mandated water quality monitoring sites. General toxin sensing of these government regulated sites fits into a market opportunity of approximately <b>$50 million</b> as shown below:</p> | ||

</html>[[File:Calgary2013_MarketOverview.png|600px|centre|thumb|Figure 1: General Overview of the North American Oil and Gas market and the Global Waste Water Monitoring markets.]]<html> | </html>[[File:Calgary2013_MarketOverview.png|600px|centre|thumb|Figure 1: General Overview of the North American Oil and Gas market and the Global Waste Water Monitoring markets.]]<html> | ||

| - | <p> | + | <p>Each of these monitoring sites is required to take multiple samples in the surrounding areas on a quarterly or annual basis. The overall number of sites for air, water, and ecosystem quality taken from the Canada-Alberta Oil Sands Environmental Monitoring Information Portal. Information from the Joint Canada-Alberta Implementation Plan is found below:</p> |

</html>[[File:Calgary2013RegulationPieChart.png|600px|centre|thumb|Figure 2. Number of sampling stations in the Alberta Oil Sands area broken down by water (blue), ecosystem (green), and air (orange) monitoring.]]<html> | </html>[[File:Calgary2013RegulationPieChart.png|600px|centre|thumb|Figure 2. Number of sampling stations in the Alberta Oil Sands area broken down by water (blue), ecosystem (green), and air (orange) monitoring.]]<html> | ||

| - | <p>Monitoring is broken down into air, water, and ecosystem quality | + | <p>Monitoring is broken down into air, water, and ecosystem quality. Our technology can be applied to over 50% of the total number of monitoring sites. The largest portion of interest is dedicated to water monitoring in tailing ponds and various acid-sensitive lakes found in the oil sands and surrounding areas. We have evaluated that our technology however, fits not only into most of the water monitoring regulation but also a vast majority of the ecosystem monitoring requirements. The number and type of monitoring sites that our technology could be utilized with is identified below:</p> |

</html>[[File:CalgaryRegulationMarketPie2.png|300px|centre|thumb|Figure 3. Sampling stations for water quality (grey) and air/ecosystem (green) showing the percentage of monitoring sites our technology could be applied to.]]<html> | </html>[[File:CalgaryRegulationMarketPie2.png|300px|centre|thumb|Figure 3. Sampling stations for water quality (grey) and air/ecosystem (green) showing the percentage of monitoring sites our technology could be applied to.]]<html> | ||

| - | + | ||

| - | <p>In total, more than 500 water and ecosystem quality sites are prime opportunities for our technology to transform | + | <p>In total, more than 500 current water and ecosystem quality sites are prime opportunities for our technology to transform current monitoring regimes. Our general toxin sensor technology has vast applications which can meet growing needs for on-site monitoring at these sites. As these needs are expected to grow substantially by the year 2015, this makes the development of our technology in-line with the expectations for market growth dictated by the government. |

</html>[[File:Calgary2013_MonitoringSites.png|600px|centre|thumb|Figure 4. Monitoring sites dictated by the Canada|Alberta Implementation Plan from the years 2011 and the expected increase in sites by 2015. Orange dots represent air quality monitoring which our technology cannot presently be applied to.]]<html> | </html>[[File:Calgary2013_MonitoringSites.png|600px|centre|thumb|Figure 4. Monitoring sites dictated by the Canada|Alberta Implementation Plan from the years 2011 and the expected increase in sites by 2015. Orange dots represent air quality monitoring which our technology cannot presently be applied to.]]<html> | ||

</html>[[File:Calgary2013_Monitoring_List2.png|550px|centre|thumb|Table 1. Regulatory sampling sites required to be monitored by the oil and gas industry in the year 2011.]]<html> | </html>[[File:Calgary2013_Monitoring_List2.png|550px|centre|thumb|Table 1. Regulatory sampling sites required to be monitored by the oil and gas industry in the year 2011.]]<html> | ||

| + | It is important to note, that while there are currently approximately 500 sampling stations which are mandated, each site performs sampling in multiple locations more than once per year. As an example, the Athabasca tributary monitoring program (a part of the Regional Aquatic Monitoring Program - RAMP) may have approximately ten or more distinct sampling locations surrounding a site which are monitored as often as once per month. Other sampling locations such as acid-sensitive lakes, may only be monitored a few times per year.</p> | ||

| - | <p> | + | <p>Our primary target market with our general toxin sensor is water-quality monitoring for oil and gas applications. This market segment is dominated by environmental regulation by government bodies for both technical and application components. However, this regulation has also led to a large market opportunity due to the large number of government mandated water quality monitoring sites. Each of these monitoring sites are required to take multiple samples in the surrounding areas on a quarterly or annual basis. The overall number of sites for air, water, and ecosystem quality taken from the Canada-Alberta Oil Sands Environmental Monitoring Information Portal and Information from the Joint Canada-Alberta Implementation Plan are as follows (numbers are the number of sites required to be monitored in Alberta alone):</p> |

| + | |||

<h2>Competitors </h2> | <h2>Competitors </h2> | ||

| - | <p> | + | <p>Currently, monitoring in the oil and gas industry is performed through both short- and long-term collection methods with samples then being shipped to an external lab for testing. This process requires transportation costs, sample processing, and wait times in which the composition of a sample can change dramatically. In addition, trained technicians are required who can operate expensive analytical lab equipment. Traditional Gas Chromatography Mass Spectrometry (GC/MS) or Fourier Transform Infrared Spectroscopy (FTIR) can cost upwards of $500 a sample to prepare and run on the equipment. Intensive sample preparation is also required, increasing both cost and testing time. Current testing regimes require multiple sample collections and tests per site to allow for proper analysis. Though these analytical technologies are highly rigorous, their cost, need for highly trained personnel, as well as sample transport make it unrealistic to meet the changing regulatory market for increased spot-test monitoring sites planned by recent legislation. We do not wish to, nor can we compete directly with this highly analytical technology, however our system provides an advantage in that sites can be pre-screened. This allows samples to be screened for toxicity both rapidly and on-site, following which samples containing toxins or some level of significant change from baseline can then be sent for further processing if highly analytical data is needed.</p> |

| + | |||

| + | <p>Biosensor technology does exist in the industry to provide a faster alternative to these traditional analytical detection methods when a simple output as to the presence of a toxin in the sample is required. The major system used by the industry currently is a technology known as Microtox®. This system uses a naturally luminescent bacteria to which an environmental sample is added. If the sample contains a toxin, the bacteria will slow in growth or die, causing a decrease in luminescence which can then be read on a spectrophotometer or luminometer.</p> | ||

| + | |||

| + | </html>[[File:Calgary2013 MicrotoxSystemExplained.png|550px|centre|thumb|Figure 4. The Microtox® system uses a luminescent bacteria. When a toxic water sample is added into the device, bacterial death occurs and the luminosity of the solution is reduced. This allows the user to determine toxicity based on the rate of death in the sample.]]<html> | ||

| - | <p> | + | <p>This test is mainly done in a laboratory environment. Although a portable version does exist and can provide results within a 30 minute time window, there are numerous concerns associated with its reliability. A similar test, ToxTrak™, is also available in both a laboratory and portable version, though bacterial survival and respiration is measured by addition of a chemical that is utilized during respiration. This technology, similar to Microtox®, encounters the same reliability concerns.</p> |

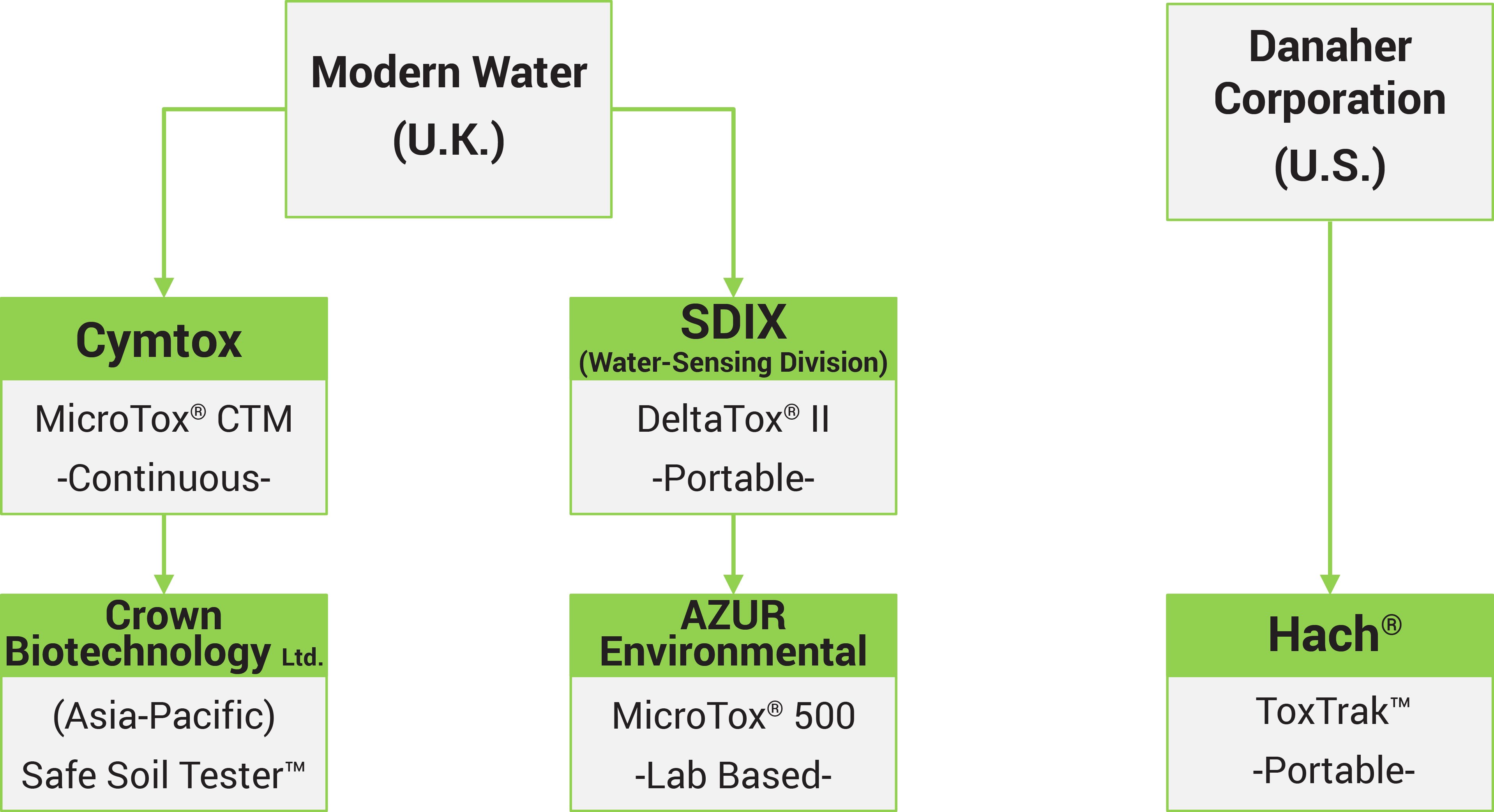

<p>Currently, the Microtox® technology is available in continuous monitoring, portable, and laboratory based systems. IP for all 3 systems is centralized in a UK based company, Modern Water. The other major biosensor technology, ToxTrak, is owned by Hach. This company is in turn owned by Danaher. </p> | <p>Currently, the Microtox® technology is available in continuous monitoring, portable, and laboratory based systems. IP for all 3 systems is centralized in a UK based company, Modern Water. The other major biosensor technology, ToxTrak, is owned by Hach. This company is in turn owned by Danaher. </p> | ||

Revision as of 00:12, 28 October 2013

FREDsense's website works best with Javascript enabled, especially on mobile devices. Please enable Javascript for optimal viewing.

Establishing Our Market

Our Field Ready Electrochemical Detector Technology is targeted to the oil and gas market. A significant market opportunity exists within the regulatory framework which has been established by the Canadian government. Spot checks are required routinely throughout each year to ensure areas of the lakes and rivers in Alberta are not being affected by the waste effluent from the oil extraction process. In fact, water monitoring represents a $50 million opportunity, and capturing 30% of this Alberta/Canada market could lead to annual profitability of $2.2 million. To reach this part of the market, we have developed a technology which provide distinct advantages compared to competitive technologies and by partnering with a company who controls a large portion of this market.

Our marketing segment of our project has been broken down into two key areas. A Marketing Analysis to determine the size of the market opportunity that is available and a Marketing Plan to demonstrate our approach to market by engaging our end-users and developing our technology.

Marketing Analysis

Industry Description and Outlook

The oil and gas market is vast; today's operations in the Alberta Oil Sands produce 1.5 million barrels per day, which is expected to double by 2020. In North America, this market’s growth and increased oil production volumes has led to large increases in the amount of contaminated water that is produced and stored by these operations. During the oil sands extraction processes, water is often used to separate out the oil from the sand. During this process, the water becomes contaminated with fine silts alongside many highly toxic chemicals, making it unsafe to return to the environment. The potential toxicity from oil sands processed water (OSPW) has led to Alberta’s zero discharge policy. All oil sands tailings water must be stored in a contained environment (known as a tailings pond) where the fine silts are settled out so the water can be reused in oil sands processing streams. In the longer term, the water is stored with the goal of eventually remediating the toxins so that the site can be reclaimed.

Today, 200 million litres of contaminated tailings water is produced every day. These tailings ponds of contaminated water cover over 176 km2, an area 50% larger than the City of Vancouver. They are expected to reach 250 km2 by 2020. Holding 840 million m3 of water as of today, this will expand their volume to 1.2 billion m3 of water (Comprehensive Guide to the Alberta Oil Sands - May 2011). Every effort is made to reuse the water in the processing cycle, however it contains highly corrosive contaminants (naphthenic acids for example) that result from the extraction process and can cause corrosion damage to equipment that can lead to expensive repairs and costly shutdowns. In addition, these tailing ponds have been found to seep into the surrounding environment, releasing toxins into nearby rivers which harm wildlife and contaminate ecologically sensitive areas.

Stemming from concerns for environmental contamination, monitoring of wastewater and the surrounding environment is mandated by the government. Through the Joint Canada-Alberta Implementation Plan released in 2011, the number of ground & surface water quality and soil testing sites along rivers & ecologically sensitive areas is set to double by 2015, with more remote testing sites to be introduced. In this plan, costs for sampling are shared unequally between government and industry players.

Large oil companies generally hire environmental monitoring and consulting companies in order to do this testing. These groups either collect and test samples themselves or have samples from many waste streams shipped to a central facility for testing. These companies are actively searching for better technologies to rapidly detect toxic compounds in process water alongside existing soil, surface water, and groundwater testing. With more remote testing sites being introduced, they also require more portable technologies and are poised to be one of the largest customer bases for our technology. The environmental sensing and monitoring market is growing substantially. In the United States, it is expected to reach $15.3 billion by 2016. Environmental consulting in the United States made $1.2 billion in profit in 2012, and is expected to grow with a compound annual growth rate of 8.7% until 2018. About 40% of this industry is focused on water and soil quality management. Globally, the water and wastewater monitoring market as of 2012 was valued at 8 billion dollars.

In addition to the increased amount of legislation around environmental monitoring, many companies are moving towards adopting a greener image, and with it, more environmentally sound policies and management practices. Alongside a need for continuous monitoring, there is a demand for technology to pulse-spot test tailing ponds alongside sites with increased ecological significance with both regular testing as well as increased frequency tests during a water quality detection event.

As a portable, fast, on-site, and easy to use toxin detector, our technology could be used to meet the need in the market for a fast, pulse-spot testing system. With this technology, results could be obtained with shorter wait-times, on-site so that sample composition changes are minimized, and could be integrated into data management processes already used in industry. This would make our system ideal for environmental sampling in many remote locations, as well as for the analysis of water composition to detect corrosive compounds that could damage oil processing equipment when reusing process water.

Beyond environmental monitoring sites, contaminated water can cause significant issues when recycled back into oil sands processing systems. Oil companies are a robust second customer base, as we could provide fast on-site monitoring for compounds that could corrode and impair machinery. Our system would act as a simple tool that could spot test monitor a given water channel providing valuable simple readout to the operator. This would add a valuable new monitoring system for oil sands plant operators to measure compounds which would potentially lead to a corrosion problem which were previously unable to be monitored on-site.

Target Markets

Our primary target market is water quality monitoring related to the oil and gas industry. This market segment is dominated by government environmental regulation. As such, it will be critical to align with government mandated requirements for monitoring technology as we will discuss in more detail. This regulation has led to a significant market opportunity due to large increases in the already numerous number of government mandated water quality monitoring sites. General toxin sensing of these government regulated sites fits into a market opportunity of approximately $50 million as shown below:

Each of these monitoring sites is required to take multiple samples in the surrounding areas on a quarterly or annual basis. The overall number of sites for air, water, and ecosystem quality taken from the Canada-Alberta Oil Sands Environmental Monitoring Information Portal. Information from the Joint Canada-Alberta Implementation Plan is found below:

Monitoring is broken down into air, water, and ecosystem quality. Our technology can be applied to over 50% of the total number of monitoring sites. The largest portion of interest is dedicated to water monitoring in tailing ponds and various acid-sensitive lakes found in the oil sands and surrounding areas. We have evaluated that our technology however, fits not only into most of the water monitoring regulation but also a vast majority of the ecosystem monitoring requirements. The number and type of monitoring sites that our technology could be utilized with is identified below:

In total, more than 500 current water and ecosystem quality sites are prime opportunities for our technology to transform current monitoring regimes. Our general toxin sensor technology has vast applications which can meet growing needs for on-site monitoring at these sites. As these needs are expected to grow substantially by the year 2015, this makes the development of our technology in-line with the expectations for market growth dictated by the government.

Our primary target market with our general toxin sensor is water-quality monitoring for oil and gas applications. This market segment is dominated by environmental regulation by government bodies for both technical and application components. However, this regulation has also led to a large market opportunity due to the large number of government mandated water quality monitoring sites. Each of these monitoring sites are required to take multiple samples in the surrounding areas on a quarterly or annual basis. The overall number of sites for air, water, and ecosystem quality taken from the Canada-Alberta Oil Sands Environmental Monitoring Information Portal and Information from the Joint Canada-Alberta Implementation Plan are as follows (numbers are the number of sites required to be monitored in Alberta alone):

Competitors

Currently, monitoring in the oil and gas industry is performed through both short- and long-term collection methods with samples then being shipped to an external lab for testing. This process requires transportation costs, sample processing, and wait times in which the composition of a sample can change dramatically. In addition, trained technicians are required who can operate expensive analytical lab equipment. Traditional Gas Chromatography Mass Spectrometry (GC/MS) or Fourier Transform Infrared Spectroscopy (FTIR) can cost upwards of $500 a sample to prepare and run on the equipment. Intensive sample preparation is also required, increasing both cost and testing time. Current testing regimes require multiple sample collections and tests per site to allow for proper analysis. Though these analytical technologies are highly rigorous, their cost, need for highly trained personnel, as well as sample transport make it unrealistic to meet the changing regulatory market for increased spot-test monitoring sites planned by recent legislation. We do not wish to, nor can we compete directly with this highly analytical technology, however our system provides an advantage in that sites can be pre-screened. This allows samples to be screened for toxicity both rapidly and on-site, following which samples containing toxins or some level of significant change from baseline can then be sent for further processing if highly analytical data is needed.

Biosensor technology does exist in the industry to provide a faster alternative to these traditional analytical detection methods when a simple output as to the presence of a toxin in the sample is required. The major system used by the industry currently is a technology known as Microtox®. This system uses a naturally luminescent bacteria to which an environmental sample is added. If the sample contains a toxin, the bacteria will slow in growth or die, causing a decrease in luminescence which can then be read on a spectrophotometer or luminometer.

This test is mainly done in a laboratory environment. Although a portable version does exist and can provide results within a 30 minute time window, there are numerous concerns associated with its reliability. A similar test, ToxTrak™, is also available in both a laboratory and portable version, though bacterial survival and respiration is measured by addition of a chemical that is utilized during respiration. This technology, similar to Microtox®, encounters the same reliability concerns.

Currently, the Microtox® technology is available in continuous monitoring, portable, and laboratory based systems. IP for all 3 systems is centralized in a UK based company, Modern Water. The other major biosensor technology, ToxTrak, is owned by Hach. This company is in turn owned by Danaher.

Modern Water acquiring these companies has suggested that the ability to detect general toxins in this and other markets is of high value and profit, particularly due to the amount that these companies were acquired for. Danahur acquired Hach for $355 million which had produced $137 million in revenue in 2012. Importantly, this suggests there is a global market for our technology.

Conclusions

From our market analysis we have identified an opportunity for our technology to be developed within the context of the oil and gas environmental monitoring program. There is a distinct need for our general toxin sensing technology which will fit into the suite of portable toxin sensing equipment to be included as mechanisms of monitoring toxins in the environment. Our technology can be applied to over 50% of the regulatory sites of which the government has determined to be key regulatory areas. This market has shown to be very profitable, and is expected to rapidly expand in the next five years. Other competitors exist in this market, primarily under the technology MicroTox® which has been largely acquired by Modern Water.

Marketing Analysis

Customers - Who Are They and How Do We Sell To Them?

An important identification is who would be the key individuals that would buy our product? As we are addressing a clear need in the monitoring market, our customers are those who would most value from new monitoring methods to detect toxins. This will be complex relationship between oilsands companies and their contracted service companies. Large oil sands companies must assess a need for this type of toxin monitoring to encourage service companies to adopt this type of technology. Because of competitive products that already exist in the market, there is a clear push for systems which report the overall toxicity of a sample. Service companies must see clear financial advantages in using our product over presently utilized competing technology. They will be the primary customer source in our market.

Customer Requirements

With a price point for our technology platform selected, it is critical to assess the requirements of our customers in order for interest in our product. In order to assess these requirements we have communicated with many industry players to determine their requirements to adopt such a technology. Our group communciated with HydroQual Laboratories based out of Calgary, a analytical laboratory which routinely monitors oil and gas as well as other industry's water samples. They demonstrated several key areas that would need to be shown to be incredibly effective in order to have interest in purchasing the technology. These included:

- Regulatory Approval - The technology must achieve appropriate regulatory approval for the oil and gas industry. Environmental Technology Verification, Environment Canada, and Health Canada approval.

- Sensitivity - The technology must be shown to very adequately demonstrate when any toxic level of any chemical is in solution (i.e. no false negatives).

- Accuracy - The identification of a toxic sample must be incredibly robust.

- Track Record - The technology should have a proven track record with numerous samples of various different compositions to demonstrate reliability within the industry. The more of this we make available to our customers the better.

It is also critical to evaluate changes that the customers would have to make in order to utilize our product as these could be barriers to purchasing the device. Our product will require a change in the technology platform used, however, using the device is simple and does not require any technical training. Therefore this may represent an advantage of our system rather than a burden. It may require some changes in staffing however, if more individuals are required to take samples on site. The data will require server space within the system of the customer, but we plan to design our system to integrate into existing server providers making this a minimal barrier.

Reaction From Specific Prospective Customers

Our product is at a early stage of development and therefore, demonstration of a full prototype is not yet a possibility. However, we have had the opportunity to talk to numerous end-user customers about our technology, it's application, and the potential market value. We spoke to HydroQual Laboratories, one of the major service providers for a myriad of oil sands companies. They hold a cornerstone for monitoring samples for oil and gas and other applications. Our talks with HydroQual have led to a validation that there is use for our product in industry. HydroQual is owned by a large service consulting based company named Golder Associates. Golder also has identified value in our product and are interested in gaining further information about how FREDsense Technologies and Golder could be working together.

Canada’s Oil Sands Innovation Alliance (COSIA) and the Oil Sands Leadership Initiative (OSLI), two oil sands consortia that analyze prospective oil sands technologies, have also provided a large amount of input into the project and have been interested in seeing its development. They have shown interest in our biosensor platform showing a clear interest from oil sands producers.

Selling Activities

Penetrating this market requires that we sell our product to as many commercially accredited laboratories as well as service companies as possible. To gain a foothold in this market, three major targets have been identified as the leading laboratories who handle oil and gas related toxicological samples:

- ALS Environmental - Most water and sedimentary analyses

- AXYS Laboratories - Sediment analysis of toxins such as PAHs

- HydroQual Laboratories - Water and sediment toxicology data

It will be critical that we partner with industry in order to demonstrate our product has a usable track record to correctly predict the toxocology of samples. This along with government approved regulations, and clear advantages to our competitiors will allow us to achieve success in selling this product.

Competitive and New Emergent Technologies - Selecting Price Point

Our product provides a distinct advantage to our target market being fast, affordable, portable, and robust. Many elements of which other general toxin biosensors do not possess. An analysis against other competitive technologies in the market follows:

Biosensor Competing Technologies

Microtox® CTM - The Microtox® Continuous Monitoring (CTM) system allows for on-line autonomous monitoring for 4 weeks without requiring maintenance, and will take continuous readings of toxicity levels in an environmental site. We believe that the method by which this technology has accomplished this continuous monitoring using live bacteria could be something that our system could be adapted to in the future. As well, other methods are being explored theoretically in order to adapt our system so that it can provide the same complement to the Microtox® technology that the portable version provides. The continuous monitoring system answers a call specifically to the requirement for long-term monitoring of sample sites. Our technology provides a solution for rapid spot-testing rather than continuous systems.

DeltaTox®II and ToxTrackP - Both of these systems are portable methods for general detection of toxins in the environment. These are direct competitors to our product line and hold a stake within the global general toxin sensing market. Displacing these technologies (i.e. market adoption) will be critical in achieving our product success. Our system provides several key advantages including a fast response, more reliable reads, and decreased cost.

Portable Analytical Devices

Portable GC/MS, HPLC, and FTIR Systems - These technologies for continuous monitoring and portable sensing using traditional methods are also being developed, as well as smaller systems for easier analysis. However, we believe that cost and ease of use of these systems will continue to be a barrier to their widespread use in field testing applications. This has been seen in the market since many of these technologies have not been widely utilized by industry.

Emerging Technologies

In addition to this direct monitoring technology, other means of collecting samples over time are being developed. SPMDs (Semi‐Permeable Membrane Device) are composed of a membrane lined with a thin film of lipid, and are put onto a metal frame to be deployed into the environment. These devices will be deployed into water systems in order to capture the bioavaliable, lipophilic pollutants present. Contaminants that can be captured by such a system belong to hydrophobic classes of chemicals (aliphatic hydrocarbons and polyaromatic hydrocarbons). These compounds are capable of penetrating and disrupting cell membranes, and often cause acute and chronic toxic effects to wildlife.

Another system known as POCIS (Polar Organic Chemical Integrative Sampler) will be used to capture polar, hydrophilic, water soluble toxins. This system is composed of microporous polyethersulfone membranes, between which a solid absorbent compound is held. These systems would be deployed in a similar fashion to the SPMD technologies, and often used in consort with the SPMD. Examples of both of these technologies are detailed below:

Both these technologies are very innovative, however can only be used for sample capture over time. They must still be retrieved and brought to a lab for sample extraction and analysis on traditional analytical machinery. As opposed to on-site spot testing or continuous active monitoring, these methods are also unable to indicate at what point in a given sample collection timeframe that a perturbing event occurred, only that one had occurred during that given time frame. On-site and continuous monitoring provides the ability to not only detect the time frame within which a change occurs, but also monitor the levels that a given condition changes over that time frame.

Using Competitive Analysis To Select Price Point

Below, is a table summarizing our competitive advantage against many of these competitive products:

Comparing the financial data from other general toxin monitoring companies, it is clear that to be competitively priced we must be able to match pricing of the Microtox® system. Due to the high prohibitive cost of this monitoring technology, and our manufacturing analysis, it would be reasonable to select price points for our technology that match the per unit cost of the cartridges, while selling our detection system at a much lower cost. This will ensure that we can remain competitive, maintain high profitability (over 15x production cost for the cartridges and 5x cost for the detector system), and expand new market avenues to private companies as well as small groups where price point would more dramatically effect. All of these key factors will highly influence our selling activities which are detailed below.

Pricing will be determined based on cost associated with the development of the technology. Because of our assessment of the market, one-use based general sensing technology of our competitors involve detectors (lab grade or portable devices) between $10,000-$25,000. Each sample test costs approximately $150-$250 depending on the specifics of the technology and the complexity of the sample to be tested. Therefore, it is our objective to reach a market pricing that would be competitive to these technologies. Our initial price point that we hope to achieve is $150 per sampling, and $2,500 per detector system.

Financial Market Assessment - Can Our Technology Be Profitable?

The monitoring market is dominated by government regulation, oil sands mining companies and their respective consultant service companies are likely to use the products and technology dictated by government bodies. Therefore, it is possible to capture a large portion of this market by gaining government support. Regulation will be the key component in seeing success in this market place. Our initial market therefore looks at the government mandated monitoring sites. An overview of this market and its profitability follows:

General toxin sensing for oil and gas applications represents a $50 Million market opportunity. The potential market profitability based solely on this government framework:

Assuming that our product can capture 30% of the target market a profitable potential of $2,625,000.The market is only expected to grow. In the next 3 years (projected to 2015) the number of sampling sites for water monitoring according to the Joint Canada|Alberta Implementation Plan.

In order to achieve this market capture, a early customer must be identified as discussed earlier in the selling activities section. Six major companies dominate the majority of water quality sensing and monitoring including HydroQual, which is responsible for a large percentage of the water toxicology sensing done for oil and gas companies. We are in the process of establishing partnerships with companies such as HydroQual Laboratories to ensure that we can capture this part of the market.

As identified in our financial assessment, in order for our company to be profitable we require 20,000 number of catridge units sold at a cost of $150 per cartridge or 1,200 units of the detector at a price of $2,500 Provided that we capture 30% of the sensing market (150 operation sites with 100 samplings per year = $375,000 profit from detector systems and $2,250,000 from catridges) who fulfill the government of Alberta’s mandated water monitoring, this will take approximately 1.5 years of active production to achieve profitability (not including manufacturing fees, etc.). This does not include potential revenue from other water management sources for oil and gas, only mandated sources provided from Environment Canada legislation.

Marketing Activities

Once we have developed a working prototype and begin manufacturing our product, we require a market strategy to implement delivery of our product. The market is composed of a large number of small companies who may have interest in purchasing this product. Therefore direct distribution will be easiest means to release our product.

These price points allow for maximum profitability while maintaining a competitive advantage in price-point to our competitors. The lower cost of the device also opens our market to not only target large service providers such as Golder Associates, HydroQual Laboratories, A&L Consulting, etc. but also smaller firms and laboratories who are more greatly affected by product price point.

We plan to advertise our product through government regulatory bodies as these institutions will dictate the acceptance of our technology in the marketplace. Our initial market strategy involves the adoption of our technology in the oil and gas sector in Alberta. This will be followed by efforts to include the remainder of Canada, targeting other mining operations including precious metals, coal, etc. and further into North America, penetrating markets in the USA.

Our company is NOT planning to act as a field service company, as the water monitoring field is dominated heavily by hundreds of small service based consulting companies. We plan to fit into oil sand providers present frameworks, which does not require that we disrupt their present service company contracts. This allows for us to penetrate more of the market, reducing potential competitors that we might have faced.

"

"