Team:Calgary Entrepreneurial/Project/Market/

From 2013.igem.org

FREDsense's website works best with Javascript enabled, especially on mobile devices. Please enable Javascript for optimal viewing.

Establishing Our Market

A significant market opportunity for a biosensor exists within the regulatory framework established by the Canadian government. Spot checks are required routinely to ensure areas of the lakes and rivers in Alberta are not being affected by the waste effluent from the oil extraction process. To reach this market, we have developed a technology which provides distinct advantages compared to competitive technologies and have partnered with key industry players.

Our marketing segment of our project has been broken down into two key areas. A Marketing Analysis to determine the size of the market opportunity that is available and a Marketing Plan to demonstrate our approach to market by engaging our end-users and developing our technology.

Marketing Analysis

Industry Description and Outlook

The oil and gas market is vast; today's operations in the Alberta Oil Sands produce 1.5 million barrels per day, which is expected to double by 2020. In North America, this market’s growth and increased oil production volumes has led to large increases in the amount of contaminated water that is produced and stored by these operations. During the oil sands extraction processes, water is often used to separate out the oil from the sand. During this process, the water becomes contaminated with fine silts alongside many highly toxic chemicals, making it unsafe to return to the environment. The potential toxicity from oil sands processed water (OSPW) has led to Alberta’s zero discharge policy. All oil sands tailings water must be stored in a contained environment (known as a tailings pond) where the fine silts are settled out so the water can be reused in oil sands processing streams. In the longer term, the water is stored with the goal of eventually remediating the toxins so that the site can be reclaimed.

Today, 200 million litres of contaminated tailings water is produced every day. These tailings ponds of contaminated water cover over 176 km2, an area 50% larger than the City of Vancouver. They are expected to reach 250 km2 by 2020. Holding 840 million m3 of water as of today, this will expand their volume to 1.2 billion m3 of water (Comprehensive Guide to the Alberta Oil Sands - May 2011). Every effort is made to reuse the water in the processing cycle, however it contains highly corrosive contaminants (naphthenic acids for example) that result from the extraction process and can cause corrosion damage to equipment that can lead to expensive repairs and costly shutdowns. In addition, these tailing ponds have been found to seep into the surrounding environment, releasing toxins into nearby rivers which harm wildlife and contaminate ecologically sensitive areas.

Stemming from concerns for environmental contamination, monitoring of wastewater and the surrounding environment is mandated by the government. Through the Joint Canada-Alberta Implementation Plan released in 2011, the number of ground & surface water quality and soil testing sites along rivers & ecologically sensitive areas is set to double by 2015, with more remote testing sites to be introduced. In this plan, costs for sampling are shared unequally between government and industry players.

Large oil companies generally hire environmental monitoring and consulting companies in order to do this testing. These groups either collect and test samples themselves or have samples from many waste streams shipped to a central facility for testing. These companies are actively searching for better technologies to rapidly detect toxic compounds in process water alongside existing soil, surface water, and groundwater testing. With more remote testing sites being introduced, they also require more portable technologies and are poised to be one of the largest customer bases for our technology. The environmental sensing and monitoring market is growing substantially. In the United States, it is expected to reach $15.3 billion by 2016. Environmental consulting in the United States made $1.2 billion in profit in 2012, and is expected to grow with a compound annual growth rate of 8.7% until 2018. About 40% of this industry is focused on water and soil quality management. Globally, the water and wastewater monitoring market as of 2012 was valued at 8 billion dollars.

In addition to the increased amount of legislation around environmental monitoring, many companies are moving towards adopting a greener image, and with it, more environmentally sound policies and management practices. Alongside a need for continuous monitoring, there is a demand for technology to pulse-spot test tailing ponds alongside sites with increased ecological significance with both regular testing as well as increased frequency tests during a water quality detection event.

As a portable, fast, on-site, and easy to use toxin detector, our technology could be used to meet the need in the market for a fast, pulse-spot testing system. With this technology, results could be obtained with shorter wait-times, on-site so that sample composition changes are minimized, and could be integrated into data management processes already used in industry. This would make our system ideal for environmental sampling in many remote locations, as well as for the analysis of water composition to detect corrosive compounds that could damage oil processing equipment when reusing process water.

Beyond environmental monitoring sites, contaminated water can cause significant issues when recycled back into oil sands processing systems. Oil companies are a robust second customer base, as we could provide fast on-site monitoring for compounds that could corrode and impair machinery. Our system would act as a simple tool that could spot test monitor a given water channel providing valuable simple readout to the operator. This would add a valuable new monitoring system for oil sands plant operators to measure compounds which would potentially lead to a corrosion problem which were previously unable to be monitored on-site.

Target Markets

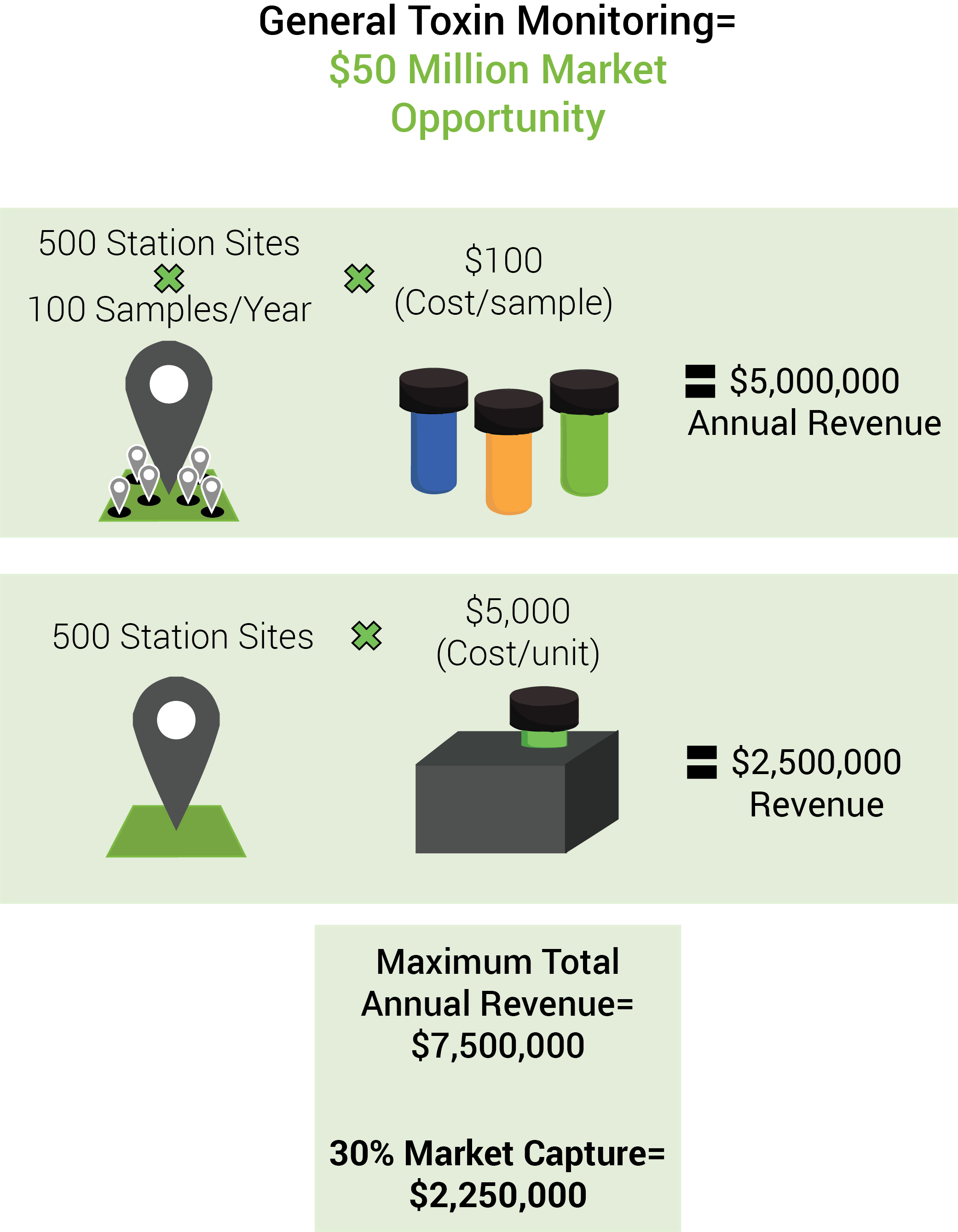

Our primary target market is water quality monitoring related to the oil and gas industry. This market segment is dominated by government environmental regulation. As such, it will be critical to align with government mandated requirements for monitoring technology as we will discuss in more detail. This regulation has led to a significant market opportunity due to large increases in the already numerous number of government mandated water quality monitoring sites. General toxin sensing of these government regulated sites fits into a market opportunity of approximately $50 million as shown below:

Each of these monitoring sites is required to take multiple samples in the surrounding areas on a quarterly or annual basis. The overall number of sites for air, water, and ecosystem quality taken from the Canada-Alberta Oil Sands Environmental Monitoring Information Portal. Information from the Joint Canada-Alberta Implementation Plan is found below:

Monitoring is broken down into air, water, and ecosystem quality. Our technology can be applied to over 50% of the total number of monitoring sites. The largest portion of interest is dedicated to water monitoring in tailing ponds and various acid-sensitive lakes found in the oil sands and surrounding areas. We have evaluated that our technology however, fits not only into most of the water monitoring regulation but also a vast majority of the ecosystem monitoring requirements. The number and type of monitoring sites that our technology could be utilized with is identified below:

In total, more than 500 current water and ecosystem quality sites are prime opportunities for our technology to transform current monitoring regimes. Our general toxin sensor technology has vast applications which can meet growing needs for on-site monitoring at these sites. As these needs are expected to grow substantially by the year 2015, this makes the development of our technology in-line with the expectations for market growth dictated by the government.

It is important to note, that while there are currently approximately 500 sampling stations which are mandated, each site performs sampling in multiple locations more than once per year. As an example, the Athabasca tributary monitoring program (a part of the Regional Aquatic Monitoring Program - RAMP) may have approximately ten or more distinct sampling locations surrounding a site which are monitored as often as once per month. Other sampling locations such as acid-sensitive lakes, may only be monitored a few times per year.

Competitors

Currently, monitoring in the oil and gas industry is performed through both short- and long-term collection methods with samples then being shipped to an external lab for testing. This process requires transportation costs, sample processing, and wait times in which the composition of a sample can change dramatically. In addition, trained technicians are required who can operate expensive analytical lab equipment. Traditional Gas Chromatography Mass Spectrometry (GC/MS) or Fourier Transform Infrared Spectroscopy (FTIR) can cost upwards of $500 a sample to prepare and run on the equipment. Intensive sample preparation is also required, increasing both cost and testing time. Current testing regimes require multiple sample collections and tests per site to allow for proper analysis. Though these analytical technologies are highly rigorous, their cost, need for highly trained personnel, as well as sample transport make it unrealistic to meet the changing regulatory market for increased spot-test monitoring sites planned by recent legislation. We do not wish to, nor can we compete directly with this highly analytical technology, however our system provides an advantage in that sites can be pre-screened. This allows samples to be screened for toxicity both rapidly and on-site, following which samples containing toxins or some level of significant change from baseline can then be sent for further processing if highly analytical data is needed.

Biosensor technology does exist in the industry to provide a faster alternative to these traditional analytical detection methods when a simple output as to the presence of a toxin in the sample is required. The major system used by the industry currently is a technology known as Microtox®. This system uses a naturally luminescent bacteria to which an environmental sample is added. If the sample contains a toxin, the bacteria will slow in growth or die, causing a decrease in luminescence which can then be read on a spectrophotometer or luminometer.

This test is mainly done in a laboratory environment. Although a portable version does exist and can provide results within a 30 minute time window, there are numerous concerns associated with its reliability. A similar test, ToxTrak™, is also available in both a laboratory and portable version, though bacterial survival and respiration is measured by addition of a chemical that is utilized during respiration. This technology, similar to Microtox®, encounters the same reliability concerns.

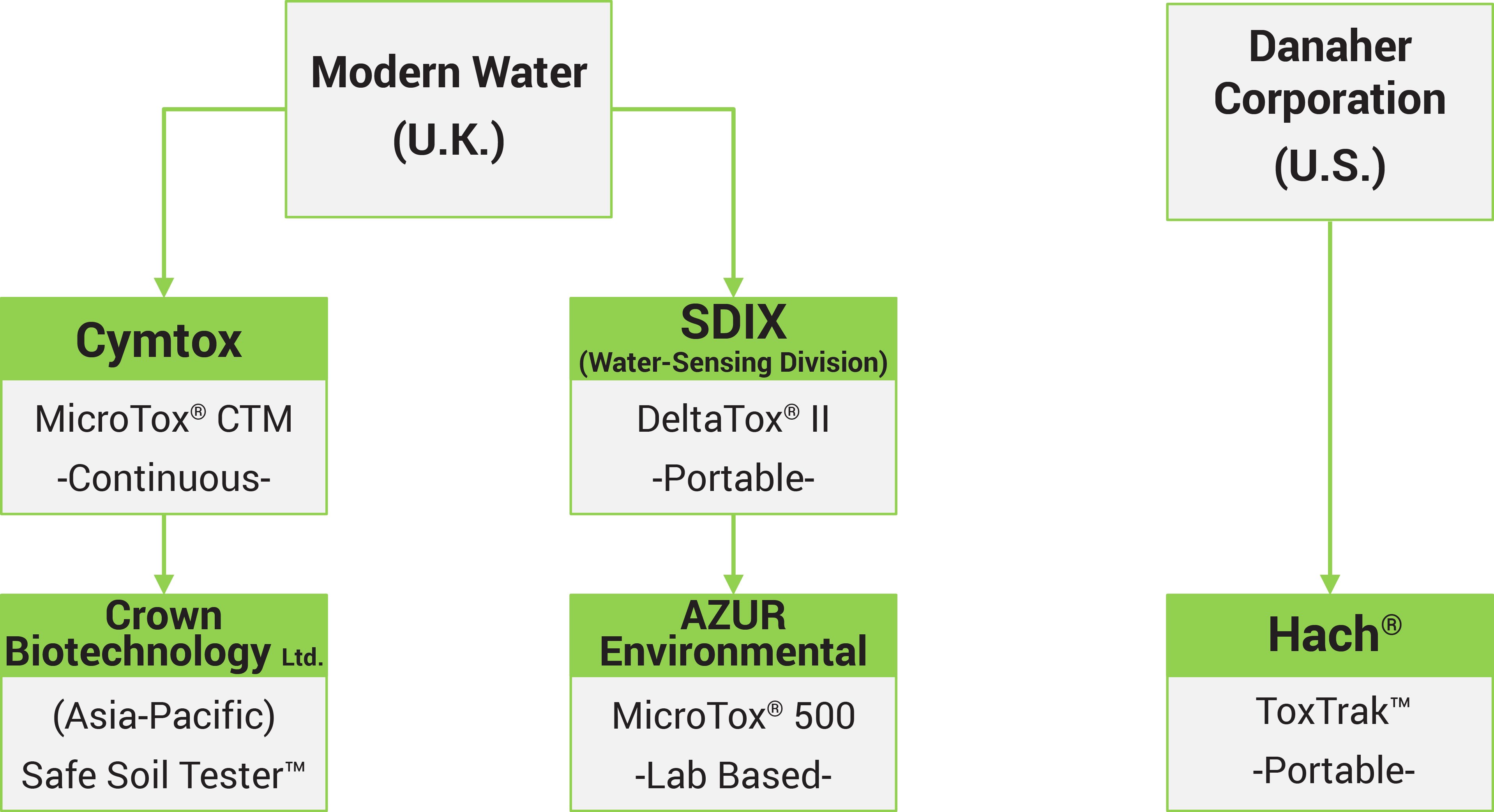

Currently, the Microtox® technology is available in continuous monitoring, portable, and laboratory based systems. IP for all 3 systems is centralized in a UK based company, Modern Water. The other major biosensor technology, ToxTrak, is owned by Hach. This company is in turn owned by Danaher.

Modern Water acquiring these companies has suggested that the ability to detect general toxins in this and other markets is of high value and profit, particularly due to the amount that these companies were acquired for. Danahur acquired Hach for $355 million which had produced $137 million in revenue in 2012. Importantly, this suggests there is a global market for our technology.

Conclusions

From our market analysis we have identified an opportunity for our technology to be developed within the context of the oil and gas environmental monitoring program. With significant increases in mandated monitoring by 2015, there is a distinct need for more rapid and portable toxin sensing technology, which will fit into the suite of existing monitoring methods. Our technology can be applied to over 50% of the regulatory sites of which the government has determined to be key regulatory areas. This market has shown to be very profitable, and is expected to rapidly grow and expand in the next five years. Other competitors exist in this market, primarily under the technology MicroTox® which has been largely acquired by Modern Water, however we provide distinct advantages over these current systems.

Marketing Plan

Customers - How Do We Sell To Them?

An important identification in our marketing plan is who the key individuals would be that would buy our product. As we are addressing a clear need in the monitoring market, our customers are those who would most value and profit from new monitoring methods to detect toxins. This will be within the complex relationship between oil sands companies and their contracted service companies. Large oil sands companies must assess a need for this type of toxin monitoring to encourage service companies to adopt this type of technology. Because of the prevalence of competitive products that already exist in the market, there is a clear push for systems which report the overall toxicity of a sample. Service companies must see clear advantages in using our product over presently utilized competing technology, both financially and analytically. They will be the primary customer source in our market. See below for an assessment of potential customers in our market:

FREDsense aims to acquire customers from the oil and gas environmental monitoring service industry as well as the analytical laboratories required for government regulated toxin monitoring. We also hope to be able to expand into small- to medium-sized oil and gas companies that would have interest in self-reporting in order to internally regulate their waste water streams and monitor toxins which can lead to potential corrosion problems.

Customer Requirements

It is critical to assess the requirements of our customers in order for our product to be adopted. In order to assess these requirements, we have communicated with many industry players to determine what they would need from our system in order to adopt such a technology. Our group communicated with HydroQual Laboratories based out of Calgary: an analytical laboratory which routinely monitors oil and gas as well as other industry water samples. They demonstrated several key areas that would need to be shown to be incredibly effective with our technology in order to have interest in purchasing it. These include:

Regulatory Approval - The technology must achieve appropriate regulatory approval for the oil and gas industry. Environmental Technology Verification, Environment Canada, and Health Canada approval.

Sensitivity - The technology must be shown to very adequately demonstrate when any toxic level of any chemical is in solution (i.e. no false negatives).

Accuracy - The identification of a toxic sample must be incredibly robust.

Track Record - The technology should have a proven track record with numerous samples of various different compositions to demonstrate reliability within the industry. The more of this we make available to our customers the better.

It is also critical to evaluate changes that the customers would have to make within their operations in order to utilize our product, as these could be barriers to the adoption of the technology. Our product will require a change in the measurement platform currently used, however, using the device is simple and does not require any technical training. Therefore, this may represent an advantage of our system rather than a burden. It may require some changes in staffing however, if more individuals are required to take samples on site. The data will require server space within the system of the customer, but we plan to design our system to integrate into existing server providers and data management systems, making this a minimal barrier.

Reaction From Specific Prospective Customers

Our product is at an early stage of development and therefore, demonstration of a full prototype is not yet a possibility. However, we have had the opportunity to talk to numerous potential end-users about our technology, its application, and the potential market value. We spoke to HydroQual Laboratories, one of the major service providers of testing for a myriad of oil sands companies. They are a cornerstone for monitoring samples from oil and gas industries as well as other applications. Our talks with HydroQual have led to a validation that there is a use for our product in industry. HydroQual is owned by the large service/consulting based company Golder Associates. Golder also has identified value in our product and are interested in gaining further information about how FREDsense Technologies and Golder could be working together.

Canada’s Oil Sands Innovation Alliance (COSIA) and the Oil Sands Leadership Initiative (OSLI), two oil sands consortia that analyze prospective oil sands technologies, have also provided a large amount of input about our technology, and have been interested in seeing its development. This suggests oil sands producers have identified our technology as having promise within the industry.

Selling Activities

Penetrating this market requires that we sell our product to as many commercially accredited laboratories as well as service companies as possible. To gain a foothold in this market, three major targets have been identified as the leading laboratories who handle oil and gas related toxicological samples:

ALS Environmental - Most water and sedimentary analyses

AXYS Laboratories - Sediment analysis of toxins such as PAHs

HydroQual Laboratories - Water and sediment toxicology data

It will be critical that we partner with industry in order to demonstrate our product has a usable track record to correctly predict the toxicology of samples. This, along with government approved regulations and the clear advantages provided by our system, will allow us to achieve success in selling our product.

Clients will receive quotes for requests above 100-cartridge orders. Pricing will contain cost of unit, shipping, and appropriate taxes. This strategy will allow us to competitively price bulk orders, saving both time and money for our company and our customers (see operations section for more information). Clients will be billed for purchases and given a 1 month window for accounts receivable. For some companies in the oil and gas sector, payment often times is made at 4 month intervals, which may make it so that we change our practices to allow for 120 days account receivable.

Competitive and New Emergent Technologies

Our product provides a distinct advantage to our target market, being fast, affordable, portable, and robust. These are many elements which other general toxin biosensors do not possess. An analysis against other competitive technologies in the market follows:

Biosensor Competing Technologies

Microtox® CTM - The Microtox® Continuous Monitoring (CTM) system allows for on-line autonomous monitoring for 4 weeks without requiring maintenance, and will take continuous readings of toxicity levels in an environmental site. We believe that the method by which this technology has accomplished this continuous monitoring using live bacteria could be something that our system could be adapted to in the future. As well, other methods are being explored theoretically in order to adapt our system so that it can provide the same complement to the Microtox® technology that the portable version provides. The continuous monitoring system answers a call specifically to the requirement for long-term monitoring of sample sites. Our technology provides a solution for rapid spot-testing rather than continuous systems.

DeltaTox®II and ToxTrackP - Both of these systems are portable methods for general detection of toxins in the environment. These are direct competitors to our product line and hold a stake within the global general toxin sensing market. Market adoption of our technology will be critical in achieving our product success. Our system provides several key advantages over these systems including a fast response, more reliable reads, and decreased cost.

Portable Analytical Devices

Portable GC/MS, HPLC, and FTIR Systems - These technologies for portable sensing using traditional analytical methods are also being developed, as well as smaller systems for easier analysis. However, we believe that cost and ease of use of these systems will continue to be a barrier to their widespread use in field testing applications. This has been seen in the market since many of these technologies have not been widely utilized by industry.

Emerging Technologies

In addition to this direct monitoring technology, other means of collecting samples over time are being developed. SPMDs (Semi‐Permeable Membrane Device) are composed of a membrane lined with a thin film of lipid, and are put onto a metal frame to be deployed into the environment. These devices will be deployed into water systems in order to capture the bioavailable, lipophilic pollutants present. Contaminants that can be captured by such a system belong to hydrophobic classes of chemicals (aliphatic hydrocarbons and polyaromatic hydrocarbons). These compounds are capable of penetrating and disrupting cell membranes, and often cause acute and chronic toxic effects to wildlife.

Another system known as POCIS (Polar Organic Chemical Integrative Sampler) will be used to capture polar, hydrophilic, water soluble toxins. This system is composed of microporous polyethersulfone membranes, between which a solid absorbent compound is held. These systems would be deployed in a similar fashion to the SPMD technologies, and often used in consort with the SPMD. Examples of both of these technologies are detailed below:

Both these technologies are very innovative, however can only be used for sample capture over time. They must still be retrieved and brought to a lab for sample extraction and analysis on traditional analytical machinery. As opposed to on-site spot testing or continuous active monitoring, these methods are also unable to indicate at what point in a given sample collection timeframe that a perturbing event occurred, only that one had occurred during that given time frame. On-site and continuous monitoring provides the ability to not only detect the time frame within which a change occurs, but also monitor the levels that a given condition changes over that time frame.

Using Competitive Analysis To Select Price Point

Below, is a table summarizing our competitive advantage against many of these competitive products:

Pricing will be determined based on cost associated with the development of the technology. While conducting our assessment of the market, we found that the single-use based general sensing technologies of our competitors involve detectors (lab grade or portable devices) between $10,000-$25,000. Each sample test costs approximately $150-$250 depending on the specifics of the technology and the complexity of the sample to be tested. Therefore, it is our objective to reach a market pricing that would be competitive to these technologies. Our initial price point that we hope to achieve is $100 per sampling, and $5,000 per detector system.

Comparing the financial data from other general toxin monitoring companies, it is clear that to be competitively priced we must be able to match or beat the pricing of the Microtox® system. Due to the high prohibitive cost of this monitoring technology, and the results of our manufacturing analysis, it would seem reasonable to select price points for our technology that are just below the cost of MicroTox® for the per unit cost of the cartridges, while selling our detection system at a much lower cost than our competitors. This will ensure that we can remain competitive, maintain high profitability (over 10x production cost for both the cartridges and the detector system), and expand new market avenues to private companies as well as small groups where price point would have a more dramatic effect on the amount of sales made. All of these key factors will highly influence our selling activities which are detailed below.

Financial Market Assessment - Can Our Technology Be Profitable?

The monitoring market is dominated by government regulation, oil sands mining companies and their respective consultant service companies are likely to use the products and technology dictated by government bodies. Therefore, it is possible to capture a large portion of this market by gaining government support. Regulation will be the key component in seeing success in this market place. Our initial market therefore looks at the government mandated monitoring sites. An overview of this market and its profitability follows:

General toxin sensing for oil and gas applications represents a $50 Million market opportunity. The potential market profitability based solely on this government framework:

Assuming that we can capture 30% of the target market, our company may reach a potential annual revenue of $2,250,000, factoring in the one-time sale of our detector unit. The market is expected to grow in the next three years (projected to 2015), due to an increase in the number of sampling sites for water monitoring according to the Joint Canada|Alberta Implementation Plan.

As identified in our financial assessment, in order for our company to be profitable we require 20,000 cartridge units sold at a cost of $100 per cartridge or 1,200 units of the detector at a price of $5,000. Provided that we capture 30% of the sensing market (150 operation sites with 100 samplings per year = $750,000 revenue from detector systems and $1,500,000 from cartridges) who fulfill the government of Alberta’s mandated water monitoring, this will take approximately 1 year of active production to achieve profitability (not including manufacturing overhead and other company-related costs). This does not include potential revenue from other water management sources for oil and gas, only mandated sources provided from Environment Canada legislation.

In order to achieve this market capture, an early customer must be identified, as discussed earlier in the selling activities section. Six major companies dominate the majority of water quality sensing and monitoring including HydroQual Laboratories, which is responsible for a large percentage of the water toxicology sensing done for oil and gas companies. We are in the process of establishing partnerships with companies such as HydroQual Laboratories to ensure that we can capture this part of the market.

Marketing Activities

Once we have developed a working prototype and begin manufacturing our product, we require a market strategy to implement delivery of our product. The market is composed of a large number of small companies who may have interest in purchasing this product. Therefore, direct distribution will be the easiest means to release our product to the market.

These price points allow for maximum profitability while maintaining a competitive advantage in cost against our competitors. The lower cost of the device also opens our market to not only target large service providers such as Golder Associates, HydroQual Laboratories, and A&L Consulting, but also smaller firms and laboratories who are more greatly impacted by product price point.

We plan to advertise our product through government regulatory bodies as these institutions will dictate the acceptance of our technology in the marketplace. Our initial market strategy involves the adoption of our technology in the oil and gas sector in Alberta. This will be followed by efforts to include the remainder of Canada, targeting other mining operations including precious metals, coal, etc. and further into North America by penetrating markets in the USA.

Our company’s strategy is to be more than a field service company. The current water monitoring field is dominated by hundreds of small service based consulting companies. This provides easy entry but allows for limited growth in this highly competitive space. In contrast, we see ourselves fitting into oil sand providers present monitoring frameworks giving us a competitive edge over present service company models. This allows for us to penetrate more of the market, reducing potential competitors that we might have faced.

Expansion into other Markets

With a versatile technological platform, we hope to be able to transition easily into other markets. This could be advantageous in terms of expanding our profit potential with second and third generation products, or it could be advantageous should we run into insurmountable hurdles in accessing our first market. Examples of such markets could include:

- Effluent water monitoring for sewage treatment and other industrial processes.

- Quality control monitoring in manufacturing processes

- Water quality monitoring for drinking water contaminants

- Pipeline monitoring for oil spills

Conclusions

From our marketing plan we have demonstrated a customer base that has shown interest in our product. We will target oil and gas service companies which are involved in monitoring toxins in this field. Additionally, we aim to market our product to private companies and major analytical laboratories in this industry. While competing technologies exist in our market, our product provides clear advantages in terms of our potential efficiency, reliability, portability, and cost. This technology fits a potential $50 million marketing opprotunity with the ability to translate easily into other markets and provide a dynamic product line.

"

"