Team:TU-Munich/Results/Economics

From 2013.igem.org

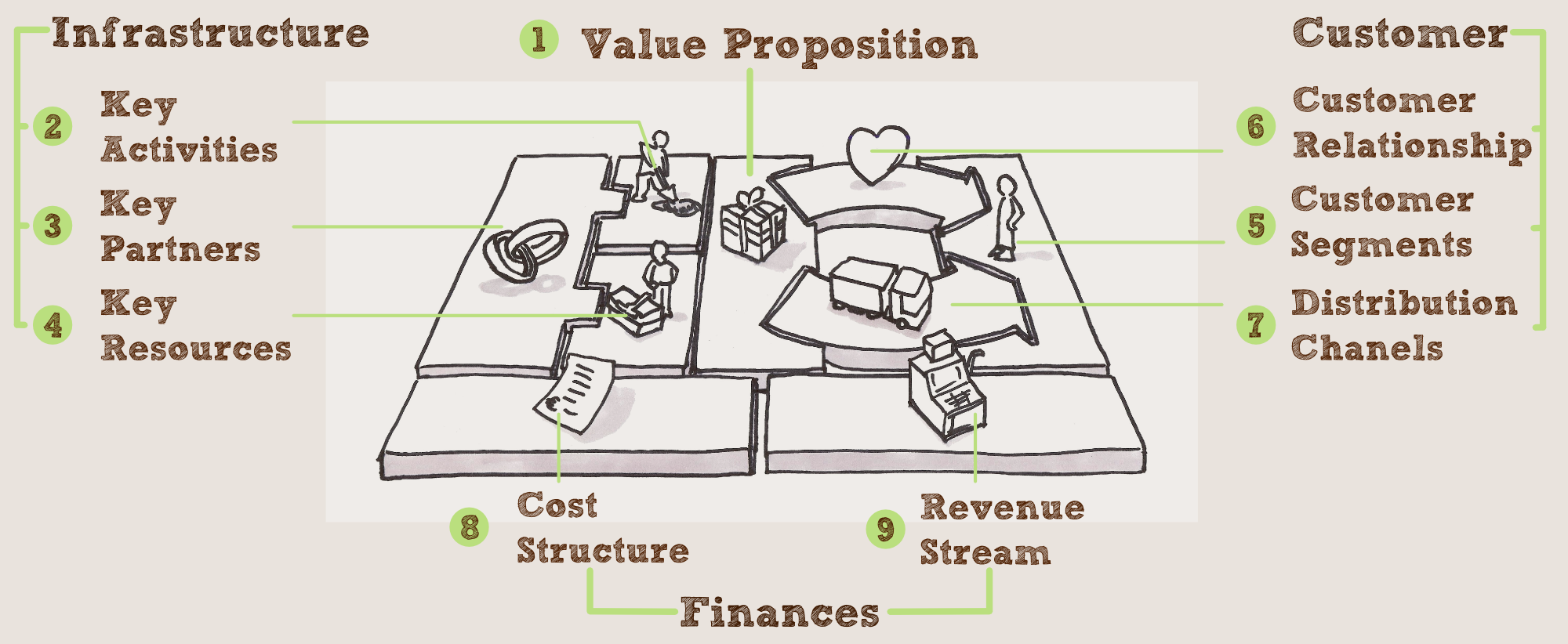

The Business Model Canvas – Standardization of Business Models

"If you can’t explain it simply, you don’t understand it well enough."

Even if “every manager and entrepreneur does have an intuitive understanding of how his business works and how value is created [...] in many cases she or he is rarely able to communicate it in a clear and simple way.” (Page 11, Alexander Osterwalder, The Business Model Ontology: a Proposition in a Design Science Approach). That is exactly what the business model Canvas was designed for: it is a strategical management tool which allows to structure a business model in a modular way into the four components:

- Value proposition

- Infrastructure (Key Activities, Key Partners, Key Resources)

- Customers (Customer Segments, Customer Relationship, Distribution Channels)

- Finances (Cost Structure, Revenue Stream)

Following this structure the business model and its essential components are more easy to understand and hence to communicate. The increased comprehensibility of the business model paired with the modular structure in which it is presented is not only more comfortable but also creates more flexibility especially for the development of new business models and business cases.

1. Value Proposition

The value proposition addresses mainly the promises to the customer. It contains all goods and services which are needed to meet the customer’s demands. A different formulation of that topic is the simple question what distinguishes my business from my competitor´s. In dependence on the product the value proposition can appear in very different forms some of which should be listed here:

- Innovation

- Performance

- Price

- Originailty/brand, especially the last is often linked to a characteristic design

- Customer adaption

- Reduction of price and or risk

- Availability

- Comfort

The value proposition is the core element of each business model because it determines all three further elements of the business model in a characteristic manner.

The value proposition of our project is based on innovation, customer adaption and price: using a completely new approach we offer the possibility to degrade environmental pollutants in waste water which cannot be degraded so far in an economically reasonable way. The conventional technologies to minimize the load of waste water with antibiotics, hormones, drugs or pesticides are based on energy intensive use of ozone or UV radiation or the less sustainable implementation of activated carbon. Our technology instead focuses on the implementation of the photoautotrophic plant Physcomitrella patens as a chassis for immobilized and self-regenerating enzymes or binding molecules against theoretically every possible target. Beside this aspect it may also boost the image of a company selling high prize products (such as pharmaceuticals) if they can claim not pollute the environment with the product they are selling.

Infrastructure: 2. Key Activities, 3. Key Partners, 4. Key Resources

The second pillar is the infrastructure containing the sub items key activities, key resources and key partners. The infrastructure forms the backbone of the business model and consists of the essential resources which are needed to create the promises to the customer formulated in the value proposition. Human, physical, financial as well as intellectual resources form the key resources which are absolutely required to successfully execute the key activities.

These are the tasks which have to be managed to fulfill the customer’s demands. As especially in emerging start up companies the key resources are often a limiting factor the performance of the enterprise can be increased with key partners. These key partners are loved and hated at the same time as they essentially enable the company to function on the one hand but automatically create important and severe addictions on the other. Examples for key partners could involve purchase and distribution networks as well as joint ventures or other strategic alliances.

Infrastructure for PhyscoFilter: The design of a moss suitable for solving the waste water treatment demands of our customers and its production and distribution in remediation rafts are our key activities. Our key resources consequently include the know how about immobilization of effector proteins in moss as well as the capacities to grow large amounts of moss biomass and build completely operating remediation rafts. In dependency of the customer’s desires, production time, costs and quantities can be varied by using different kinds of bioreactors for moss production ranging from inexpensive open pond reactors with a low space-time-yield to high efficient tube or wave bioreactors for the highly defined production of increased amounts of moss biomass in short times. These design and production capacities require human as well as physical resources in form of scientists and bioreactors/laboratory infrastructure. Furthermore we have a demand on intellectual property on several important genetic elements which are already patented at the moment. Originally patents were designed for the protection of inventions in order to obtain a refinancing of the costs invested to generate the invention, so in order to obtain an exclusive market position a biotechnology company which was contacted by us, stated that we would only have to pay comparatively few license fees due to the fact that we act on a very different market than they do and do not generate competition. We would like to establish collaborations with the greenovation and the pieris company as strategic partners. Pieris is a global leader in the development of binding molecules against targets based on the Anticalin technology. We would like them to perform commissioned developments of binding molecules against targets that interest our customers. After having combined the developed effector proteins on a DNA level with the necessary genetic environment to work in Physcomitrella patens we would like to let greenovation transform our DNA constructs into moss plants and select for a monoclonal, highly active plant. The generated moss lines are further treated, especially grown and distributed, by our company.

- Development of effector proteins

- Transformation of moss and clonal selection

- Production and implementation of rafts and filters

- Intellectual property issues

Customers: 5. Customer Segments, 6. Customer Relationship, 7. Distribution Chanels

The third pillar in the business model canvas is formed by the customers. The selection of customers directly affects the customer relationship and the distribution channel as well as the revenue streams. Mostly the customers are clustered into groups according to their similar demands or characteristics. Examples for customer clustering could be the following customer orientations:

- Mass market – no increased adaption to the customer as the demands do not vary enough

- Niche market – the opposite of mass markets: strong customer adaption and tailor made solutions

- Diversification

- Multi-sided platform – the technology provides much flexibility in order to fulfill a huge amount of requirements

There are at least two different audiences to address as customers. On the one hand we could create a moss degrading a wide range of pollutants which occur extensively in all parts of western civilized countries as for example antibiotics, hormones or drugs. This moss would address all companies involved in the public waste water treatment. On the other hand the utilization of highly customized moss(degrading only a small number of pollutants) at hot spots of pollutant emission could be a sensible alternative.

As already mentioned above the choice of customers directly takes effect on the distribution channels (as well as the value proposition). Demonstrative examples therefore are the mostly cost effective and efficient distribution channels chosen for the addressing of mass markets. This orientation determines a less personal customer relationship (up to completely automated services or self-service) whereas a highly specialized, customer adapted solution will automatically include a raised personal communication between customer and entrepreneur. Summarized the value proposition directly influences the distribution channel and customer relationship.

In contrast the sale of moss for a wide range of waste water treatment will automatically require less adaption to customer’s demands and therefore be less personal, the development of tailor-made moss for a specific customer’s request will lead to an intensive and personal contact to the customer in order to collect the necessary information.

Finances: 8. Cost Structure, 9. Revenue Stream

The fourth pillar of the Business Model Canvas deals with the financial structure of a company. These can be divided into two mutually dependent aspects: the cost structure dealing with the occurrence of costs inside the company and the revenue stream composing how a company generates financial income. The cost structure is mainly divided into two partly contrary points of view: while a cost-driven structure focuses on the reduction of costs a value-driven cost structure prefers the warranty of high quality over cost effectiveness. Both strategies are composed of fixed and variable costs. The revenue stream instead concentrates on how a company actually earns money. Different possibilities of how to place a product on the market could be:

- Asset sale – ownership rights of a physical good

- Usage fee – charge which has to be paid for a certain use

- Subscription fee – income based on selling continuous services

- Lending/Leasing/renting – the classical temporary sell of rights for a good

- Licensing – selling of intellectual property

- Brokerage fee – a charge generated for the intermediation of two business partners

- Advertising – often applied at websites: fees generated by product advertisement

The cost structure would be formed on a scientific layer by spendings to our strategic partners Pieris and greenovation for the development of binding molecules and stable & active moss lines as well as by the in house production of moss biomass and remediation rafts. The sold services to the customer could lead from the development and delivery of the remediation rafts to a complete service which guaranties to effectively clean the waste water produced by our customer. On a non-scientific layer our cost structure would be significantly affected by a small number of field workers who stay in direct contact with our customers ranging from the first analysis of their waste water problems to the successful running of a remediation plant using moss.

As diversified as the internal cost structure is in dependency on the distribution channels utilized, can be the revenue streams. Of course especially specific waste water customers could pay either for the development and first installation of remediation rafts as well as for the complete service ensuring all means necessary for an efficient degradation of pollutants.

However in case of all companies involved in the public waste water treatment a different revenue stream concept might be interesting. Similar to the green dot ![]() the occurring costs of a comprehensive waste water treatment could be paid in advance by the companies releasing these pollutants (e.g. pharmaceutical companies would pay for the degradation of antibiotics, hormones and other drugs they sell). Following this concept the manufacturer of a pollutant would have to take resposibility for the correct degradation of his products which are released in the environment in advance.

A pioneering vision could consist of the idea that transgenic moss is used in industrialized countries to effectively clean waste water. The money earned with this could be reinvested to develop moss for the sufficient purification of drinking water in developing countries. That way our moss system could not only preserve the world’s most important resource for further generations in industrialized countries but help to explore previously not accessible water resources in less developed countries as well and thus could make a contribution to a global improvement in living conditions – a long-cherished dream of humanity.

the occurring costs of a comprehensive waste water treatment could be paid in advance by the companies releasing these pollutants (e.g. pharmaceutical companies would pay for the degradation of antibiotics, hormones and other drugs they sell). Following this concept the manufacturer of a pollutant would have to take resposibility for the correct degradation of his products which are released in the environment in advance.

A pioneering vision could consist of the idea that transgenic moss is used in industrialized countries to effectively clean waste water. The money earned with this could be reinvested to develop moss for the sufficient purification of drinking water in developing countries. That way our moss system could not only preserve the world’s most important resource for further generations in industrialized countries but help to explore previously not accessible water resources in less developed countries as well and thus could make a contribution to a global improvement in living conditions – a long-cherished dream of humanity.

A comparison of biological and non-biological remediation has been published for all hazardous waste sites within the United States in which bioremediation with US$ 75 billion showed a clear advantages compared to conventional techniques with $ 750 billion http://udel.edu/~gshriver/pdf/Pimenteletal1997.pdf Pmentel et al., 1997.

In the last two decades phytoremediation has proven to be an economically competitive technology bringing new opportunities for waste water and soil managment. Phytoremediation combines many factors which add to its cost-effectiveness in comparison to traditional treatment techniques such as its low operating costs due to the fact that it does not need any additional energy input as it is solar powered. In addition almost no construction material is needed as the plant biomass generates itself. On top of all this phytoremediation takes place in situ meaning no transportation of the contaminated water or soil is needed resulting in even lower costs in manpower and material.

| Contaminant and matrix | Phytoremediation | Conventional treatment | Projected savings | ||

|---|---|---|---|---|---|

| Application | Estimated cost | Application | Estimated cost | ||

| Lead in soil (1 acre) | Extraction, harvest and disposal | $150,000 - 250,000 | Excavate and landfill | $500,000 | 50-65% |

| Solvents in groundwater (2.5 acres) | Degradation and hydraulic control | $200,000 for installation and initial maintenance | Pump and treat | $700,000 annual operating cost | 50% cost savings by 3rd year |

| Total petroleum hydrocarbons in soil (1 acre) | In situ degradation | $50,000-100,000 | Excavate and landfill or incineration | $500,000 | 80% |

Consideration of Intellectual Property

Besides the genes of the effector constructs which will be newly developed in most cases in dependency of the targeted pollutant, the genes controlling the expression are partly protected by patent regulations. During our research on this topic we found out that mainly our used promoter pActin 5 is so far intellectual property of the greenovation Biotech GmbH and protected by [http://www.archpatent.com/patents/7538259 US patent 7538259]. Furthermore motifs enhancing the general gene expression in moss would be very valuable for us but are protected by [http://patents.justia.com/patent/20080248523 European Patent Application No. 03017343.9]. Therefore we addressed this topic in our expert counsel with Dr. Schaaf. As the major purpose of intellectual property regulations is that a company is protected against direct competitors, it is likely that we would get very generous license conditions because we are not direct competitors to the greenovation Biotech GmbH.

Expert interview with Greenovation

In September we went on a road trip to visit interesting companies and experts to get some consultation on our plans. As there is a biotech company which successfully employs Physcomitrella patens as a production organism for therapeutic proteins it became clear that we have to meet a responsible person of this company. Dr. Schaaf, the Principal Scientist of [http://www.greenovation.com/index.html Greenovation] invited us for a discussion and subsequently he showed us the production facility and the other labs of Greenovation. During the meeting we discussed their and our work flow for Physcomitrella, talked about production rates of therapeutic proteins and learned cultivation condition in a bioreactor as well as in nature. During the discussion we also talked about the possibility that we could order the transformation of PhyscoFilter plants (so called BryoTechnology). This theoretical collaboration would be possible and would cost us 50 000 to 70 000 € per effector including DNA preparation, transformation and expression analysis of 1000 clones. Beside the possibility of a collaboration with PhyscoFilter the company also holds patents which could in theory block the application of Physcomitrella for commercial phytoremediation. In this case it would become necessary to buy a license for the usage of transgenic Phycomitrella plants. Other experts we have consulted can be found in our Advisory Board.

References:

http://www.hec.unil.ch/aosterwa/phd/osterwalder_phd_bm_ontology.pdf Alexander Osterwalder, 2004 THE BUSINESS MODEL ONTOLOGY A PROPOSITION IN A DESIGN SCIENCE APPROACH page 11

http://udel.edu/~gshriver/pdf/Pimenteletal1997.pdf Pmentel et al., 1997 Pimentel, D., Wilson, C., McCullum, C., Huang, R., Dwen, P., Flack, J. Tran, Q., Saltman, T., Cliff, T. (1997). Economic and environmental benefits of biodiversity. BioScience, Vol. 47, No. 11., pp. 747-757.

http://www.greenovation.com/index.html Homepage of greenovation biotech GmbH

"

"

AutoAnnotator:

Follow us:

Address:

iGEM Team TU-Munich

Emil-Erlenmeyer-Forum 5

85354 Freising, Germany

Email: igem@wzw.tum.de

Phone: +49 8161 71-4351